News

With Equirus Sole Advisor to Kalpataru Projects, Vindhyachal Expressway Sold to to Actis

Mumbai, January 16, 2026: Mid-market specialist investment banking firm Equirus Capital has announced the successful completion of the 100 per cent stake sale of Vindhyachal Expressway, an 89-km, four-lane operational highway asset of Kalpataru Projects International Limited (KPIL), to leading global private equity investor Actis. Equirus acted as the sole financial advisor to Kalpataru Projects on the transaction.

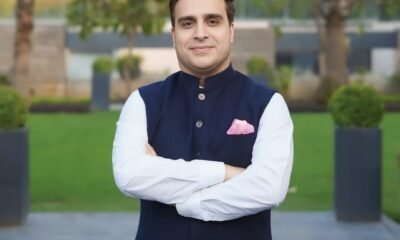

The divestment marks the 11th successful road M&A transaction advised by Equirus, further reinforcing its leadership in infrastructure monetisation and capital recycling mandates, particularly for mid-market companies. “This transaction underscores our differentiated capabilities in yield-oriented infrastructure assets and road M&A, where value creation is driven by cash-flow durability, risk allocation, and long-term return optimisation. Leveraging deep sector expertise and rigorous process management, we led the transaction end-to-end — from structuring and asset positioning to negotiations and closure,” said Vijay Agrawal, Managing Director and Sector Lead – Infrastructure and Real Estate, Equirus Capital.

As per Kalpataru Projects’ disclosure to stock exchanges, the transaction values the Vindhyachal Expressway asset at an estimated enterprise value of approximately INR 775 crore, subject to closing adjustments. The company also confirmed that “All necessary approvals and conditions precedent for the transaction have been successfully completed,” with the sale expected to be finalised before the long stop date of January 31, 2026.

Brokerages tracking Kalpataru Projects have viewed the transaction positively, noting, “The divestment is financially positive for KPIL, as the asset contributes just ~0.43% of FY24 consolidated revenue while unlocking meaningful capital. The proceeds can strengthen the balance sheet and support redeployment into core EPC segments and growth opportunities, improving capital efficiency without impacting operating scale.”

“This is another example of a win-win deal that we have been able to seal providing Kalpataru Power with strategic capital recycling while giving Actis ownership of a high-quality, stable-yield road asset aligned with its long-term investment strategy,” Agrawal added.

Vindhyachal Expressway operates under a build-operate-transfer (BOT) concession with a residual concession period of over 20 years. As of March 31, 2024, the asset reported revenue of INR 85.07 crore and a net worth of INR 144.55 crore. The project stretch is located on NH-7 from Rewa to the Madhya Pradesh–Uttar Pradesh border, with traffic largely driven by inter-state commercial vehicle movement.

-

News4 weeks ago

News4 weeks agoJewar Airport ‘Ready’, Likely to Be Inaugurated by PM Modi By Late Next Month

-

News1 week ago

News1 week agoHiranandani Communities Launches Watersports Centre at Premium Coastal Hiranandani Sands, Alibaug Township

-

News7 days ago

News7 days agoStrategic Partnership between Brigade Group, Primus Senior Living to Develop Senior Living Communities

-

News4 weeks ago

News4 weeks agoAshiana Care Homes & Epoch Elder Care Partner to Strengthen Assisted Living & Specialized Senior Care in India

-

News2 weeks ago

News2 weeks agoSambhav Homes Completes 85-acre Land Delivery for ₹600-Cr ESR Hosur Advanced Manufacturing Park

-

Interviews3 weeks ago

Interviews3 weeks agoFrom Square Footage to Soul: Redefining the Urban Living Ecosystem

-

News4 weeks ago

News4 weeks agoNew Training and Certification System Implemented for Real Estate Agents in Uttar Pradesh

-

News7 days ago

News7 days agoFY27 Outlook Residential Real Estate: High Base and Affordability Challenges; Tier I Mid-Premium Segment Resilient