Main

ANAROCK Real Estate Consumer Outlook – H2 2018

Anuj Puri

Chairman ANAROCK Property Consultants

51% home buyers seek rental income, 39% prefer affordable housing

- 39% prefer to invest in housing priced below ₹40 Lakh

- 68% seek property for end-use; 52% favour compact 2BHKs

- 51% of investors focused on rental returns

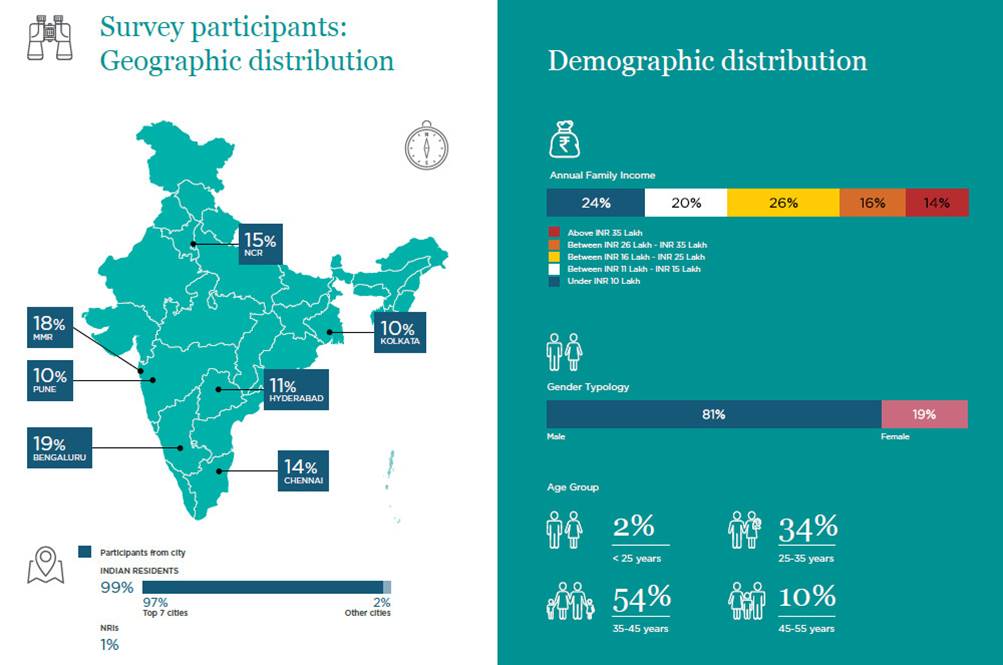

As many as 81% of polled aspiring homebuyers acknowledge Indian real estate’s improved and improving transparency, discipline and accountability post implementation of regulatory policies, reveals ANAROCK Property Consultants’ ‘Real Estate Consumer Outlook: H2 2018’.

Commenting on the survey, Anuj Puri, Chairman – ANAROCK Property Consultants says, “With the now discernible impact of RERA, DeMo and GST, housing sales are seeing an upward trajectory in 2018 q-o-q. New launches have also gone up this year with affordable housing witnessing significant growth. NRIs see India’s rebooted real estate market environment conducive enough to justify property investments, especially on the back of the depreciating rupee.”

- Nearly 69% prospective buyers are looking to buy property for end-use

- 84% are looking for homes which are either ready-to-move-in or slated to complete in the next 6 months. Ready-to-move-in properties are garnering maximum interest from buyers who prefer WYSIWYG (what you see is what you get) assurance.

- Buyers continue to perceive risks associated with newly-launched projects in terms of delays and shady dealings by some developers

- 61% property seekers are abandoning their prolonged wait-and-watch mode and are looking to buy a property within a year.

- As many as 24% will take the plunge and buy their property immediately, while 61% are looking to buy within the next one year.

“New millennials focused on home purchase rather than renting show an overwhelming preference for compact 2BHK configurations,” says Puri. ”In fact, 52% respondents lean towards this specification. Young professionals prefer to buy homes in locations close to their workplaces and are small enough to be affordable both on base cost and maintenance.”

The survey also reveals that besides real estate, the stock market and mutual funds have overtaken fixed deposits to become the 2nd most-preferred asset class for investment. 23% respondents favour stock market and mutual fund investments, followed by fixed deposits with just 14%. Gold has lost its sheen in most metros except the southern cities of Chennai and Hyderabad.

Other survey findings:

- New consumers now rule the previously investor-driven realty market and have the upper edge in the strengthened regulatory environment.

- Investors are ready to exit the market even at lower profit margins.

- Developers are now aware that apart from various other factors, the power of social media has put buyers in the driver’s seat and customer satisfaction cannot be trifled with before, during and after a sale.

Download ANAROCK’s survey at https://bit.ly/2OP6xyS

-

News2 weeks ago

News2 weeks agoHiranandani Communities Launches Watersports Centre at Premium Coastal Hiranandani Sands, Alibaug Township

-

News2 weeks ago

News2 weeks agoStrategic Partnership between Brigade Group, Primus Senior Living to Develop Senior Living Communities

-

News3 weeks ago

News3 weeks agoSambhav Homes Completes 85-acre Land Delivery for ₹600-Cr ESR Hosur Advanced Manufacturing Park

-

Guest Column1 week ago

Guest Column1 week agoRetail Trends to Watch Out for in 2026

-

News2 weeks ago

News2 weeks agoFY27 Outlook Residential Real Estate: High Base and Affordability Challenges; Tier I Mid-Premium Segment Resilient

-

News4 weeks ago

News4 weeks agoEnviro Infra delivers Strong Q3 & 9M FY26 Performance, Nine Month YoY Growth 7.9% in Revenues

-

News2 weeks ago

News2 weeks agoTARC Marks New Milestone at TARC Kailasa with Grand Tower Launch, New Experience Gallery Reveal

-

News3 weeks ago

News3 weeks agoFive Listed Indian REITs Distribute Over ₹2,450 Cr to Unitholders in Q3 FY26: Indian REITs Association