Report

Strong recovery seen across real estate in Q3 2021; Residential at the forefront of revival: CBRE report

India, 09 Nov 2021: Real estate consulting firm, CBRE South Asia on Tuesday announced the findings of its ‘India Market Monitor – Q3 2021’. The report discusses the growth, trends, and dynamics across various segments in the real estate sector in India.

According to the report, housing sales jumped nearly 46% Q-o-Q to 50,000 units in Q3 2021 and sales rebounded significantly by approximately 86% y-o-y on a YTD basis. Office leasing activity reached 13.5 million sq. ft. in Q3 2021 growing at about 140% Q-o-Q, with the YTD number reaching 25 million sq. ft. for the key cities. With 3PL and E-commerce fuelling demand, the Industrial & Logistics leasing activity crossed 9 million sq. ft. in Q3 2021, growing at about 6% Q-o-Q and touching 23 million sq. ft. for 9 months 2021.

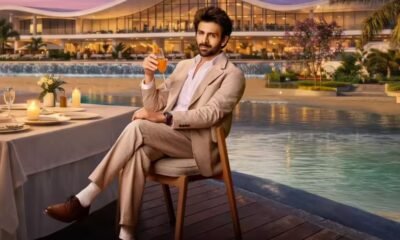

Anshuman Magazine, Chairman & CEO, India, South East Asia, Middle East & Africa, CBRE, said, “India’s real estate market has proven to be extremely resilient over the last year. The overall outlook for the Indian real estate continues to be positive – back of an accelerated vaccination drive, policy reforms, and increasing urbanization.”

Anshuman Magazine, Chairman & CEO, India, South East Asia, Middle East & Africa, CBRE, said, “India’s real estate market has proven to be extremely resilient over the last year. The overall outlook for the Indian real estate continues to be positive – back of an accelerated vaccination drive, policy reforms, and increasing urbanization.”

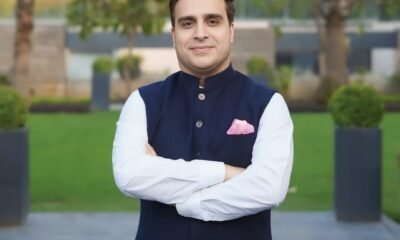

Abhinav Joshi, Head of Research – India, Middle East & North Africa, CBRE said, “With ease of restrictions post-COVID’s second wave, the real estate industry has witnessed steady growth. The green shoots of recovery have been observed across sectors – including office, residential, retail, and industry & logistics, which is likely to sustain momentum for next few months.”

Abhinav Joshi, Head of Research – India, Middle East & North Africa, CBRE said, “With ease of restrictions post-COVID’s second wave, the real estate industry has witnessed steady growth. The green shoots of recovery have been observed across sectors – including office, residential, retail, and industry & logistics, which is likely to sustain momentum for next few months.”

Residential – Sustained attractive mortgage regime and government incentives led to strong sectorial recovery:

- Pune led housing sales in Q3 2021 with 33%, followed by Mumbai (23%), Bangalore (17%) and Hyderabad (13%)

- At 47% and 31%, mid segment and affordable/ budget respectively were the dominant growth driver of sales in Q3 2021

- New project launches jumped by nearly 37% Q-o-Q to reach 48,950 units in Q3 2021

Market Outlook:

- Mid-end and affordable segments to continue driving sales; state government incentives and an enabling mortgage regime to reinforce upward momentum.

- Rental housing to get a boost post the implementation of the Model Tenancy Act, thereby creating an alternate asset class for developers; fillip expected for co-living and student housing segments.

- Increased appetite from millennials and first-time home buyers; larger unit sizes and plotted developments to gain momentum.

- Project execution capabilities and cashflow management would be critical; stress funds to witness increased traction.

- Appreciation of commodity and asset prices as well as hardening of interest rates – key risks that could limit growth in sales.

Office – Recovery strengthened as occupier decision making picked up. Supply addition in Q3 2021 touched nearly 13.5 million sq. ft. growing by about 30% Q-o-Q:

- Small- to medium-sized deals (up to 50,000 sq.ft.) dominated space take-up with a share of almost 80% in Q3 2021

- Hyderabad, followed by Delhi NCR and Mumbai dominated supply, with a combined share of 84%

- Hyderabad, Bangalore and Mumbai closely followed by Delhi-NCR led demand and accounted for over 80% of total absorption.

Market Outlook:

- As mobility improves and a comeback to the physical office environment picks up, overall absorption is expected to grow.

- As occupiers recognise the significance of the physical office as a centre for collaboration, connection and culture; a shift in workplace design is likely with more allocation to ‘we’ space over ‘me’ space.

- Occupiers are expected to incorporate more flexible spaces while re-optimising their portfolios with the realignment of ‘core + flex’ themes.

- Despite an increased appetite for hybrid work, the frequency of remote working is anticipated to be low (such as once a month); occupiers are also likely to determine their remote working eligibility post ‘return-to-office’ strategies.

- Developers are expected to enhance existing assets through better amenities, sustainability and health & safety measures, technological upgradation to improve occupancies.

- Investors are expected to take note of strong occupiers’ expansion intentions and monitor working patterns in their assets I portfolios; office assets to continue to remain high on the investor radar

Industrial & Logistics – Warehouse leasing activity witnessed a 6% Q-o-Q growth and crossed 9 million sq. ft. in Q3 2021. Space take-up for the first nine months of 2021 reached 23 million sq. ft.

- Medium-to-large sized deals dominated the leasing activity with a share of 55%.

- Bangalore led I&L demand with a share of 32%, followed by Delhi (22%) and Mumbai (12%).

- Leasing momentum expected to remain strong on the back of demand by 3PL players and e-commerce sectors.

I&L Market Outlook:

- Overall supply to cross 25 mn sq. ft by the end of 2021, while space-take up to cross 32 million sq. ft. in 2021.

- Occupiers are expected to display a strong inclination towards high-quality warehouses located near consumption hubs.

- Global / domestic investors to target both greenfield and portfolio acquisitions – leading to an increase in I&L investment quantum.

- Increased focus on automation / modern logistics facilities and speedy project completions to be key for developers to accommodate surging demand.

Retail – Retail leasing activity touched 0.6 million. Sq. ft. in Q3 2021 across Grade A malls and high streets, witnessing a Q-on-Q growth of nearly 165%

- Leasing activity was led by Hyderabad (38%) followed by Delhi-NCR (26%) and Bangalore (12%)

- Fashion & Apparel, and Supermarkets were the major growth drivers for the retail segment – contributing 26% and 16% to the demand in Q3 2021

Market Outlook:

- Lease structures between landlords and retailers are expected to continue to evolve with a greater emphasis on partnerships

- Retailers are expected to go beyond malls and expand footprint in high streets, mixed use, and standalone buildings

- Retailers are likely to undertake digital enhancement of stores to enrich the consumer experience and improve store performance

- Accelerated adoption of omnichannel by retailers to carer to the rapid growth of e-commerce and dramatic shift in consumer demand

Store designs likely to evolve in-tandem with a shift in consumer behaviour through re-shuffle in space allocation

-

News4 weeks ago

News4 weeks agoUnion Budget 2026: Infrastructure-Led Growth Sets Stage for Real Estate Expansion Beyond Metros

-

News4 weeks ago

News4 weeks agoNCDRC Directs District Magistrate to Take Over Control of Much Delayed Greater Noida Project

-

News4 weeks ago

News4 weeks agoBudget 2026 Positions Tourism & Hospitality as Economic Multiplier, Not Support Sector

-

News3 weeks ago

News3 weeks agoJewar Airport ‘Ready’, Likely to Be Inaugurated by PM Modi By Late Next Month

-

News5 days ago

News5 days agoHiranandani Communities Launches Watersports Centre at Premium Coastal Hiranandani Sands, Alibaug Township

-

News4 weeks ago

News4 weeks agoAshiana Care Homes & Epoch Elder Care Partner to Strengthen Assisted Living & Specialized Senior Care in India

-

Interviews3 weeks ago

Interviews3 weeks agoFrom Square Footage to Soul: Redefining the Urban Living Ecosystem

-

News3 weeks ago

News3 weeks agoNew Training and Certification System Implemented for Real Estate Agents in Uttar Pradesh