News

Piramal Capital & Housing Finance, India Mortgage Guarantee Corporation join Hands to offer ‘Gruh Setu Home Loan’

Monday, March 16, 2022: Piramal Capital & Housing Finance Limited (PCHFL), the wholly-owned subsidiary of Piramal Enterprises Limited, has partnered with India Mortgage Guarantee Corporation (IMGC), to offer Gruh Setu Home Loan – mortgage guarantee backed affordable home loans to customers from the unserved and underserved regions.

Gruh Setu Home Loan aims to cater to the aspirational needs of salaried and self-employed customers across geographies and take them a step closer to owning their dream home. The loan offering is designed to extend loans to individuals who receive salary by bank or cash, pensioners, employees of proprietorships and partnership firms as well as self-employed professionals like doctors or architects, small business owners, proprietors and partners of partnership firms.

Jairam Sridharan, Managing Director, PCHFL, said, “Piramal’s Affordable Housing solutions are targeted towards the unserved and underserved customers of Bharat. While we have designed specific products to serve this population, there is a segment that is presently credit unviable. Our new offering Gruh Setu, created in partnership with IMGC, allows us to expand credit into this population with the support of a mortgage guarantee. We expect this partnership to generate 10-12% of our housing business.”

A press release issued by the company says that the partnership with IMGC will enable PCHFL to deepen its offering through 300+ branches located across the country. Under this product, PCHFL will offer home loans ranging from Rs 5 lakh to Rs 75 lakhs for tenures up to 25 years at highly affordable rates.

Speaking on the partnership, Mahesh Misra, CEO, IMGC, said, “We are delighted to partner with Piramal Capital & Housing Finance. Piramal’s domain expertise in real estate will result in a well-structured mortgage guarantee backed home loan product that will help fulfill the ‘Early Home Ownership’ dream of first-time home buyers in India. It will also provide affordable home loans, through lower down payments, longer loan tenures, and lower EMIs. IMGC will offer complete support to PCHFL in empowering the underserved markets and expanding its operations to 1000+ cities.”

With the acquisition of DHFL, PCHFL is one of the leading players in the retail lending segment with access to over 1 million lifetime customers, presence in 24 states with a network of over 300 branches. PCHFL plans to expand its operations to about 1,000 cities, with physical presence in about 500-600 cities, over the next three years. The company leverages the “phygital” lending platform driven by Machine Learning (ML) and Artificial Intelligence (AI), including the new mobile app.

News3 weeks ago

News3 weeks agoUnity Group Launches Unity One Elegante Mall at Netaji Subhash Place, Delhi

News2 days ago

News2 days agoMumbai Returns to Pre-Pandemic Investment Levels, Surpasses $1 Billion 4th Consecutive Year: Cushman & Wakefield

News2 days ago

News2 days agoGurugram Premium Segment Drives Projected Rs 6.65 Lakh Crore Market: ANAROCK

News1 day ago

News1 day agoAdani Cement and Coolbrook to Deploy World’s First Commercial Rotodynamic Heater for Cement Decarbonisation

News2 days ago

News2 days agoTIL Ltd Reports Q2 FY26 Results with Enhanced Order Book Position, Strong Execution Momentum

News1 day ago

News1 day agoRobust Demand & New Launches Propel Sri Lotus Developers’ Strong Q2 FY26 Results

News2 weeks ago

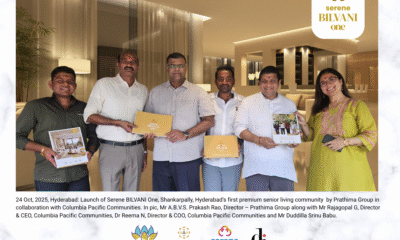

News2 weeks agoSerene Communities Announces ₹400 Crore Investment to Bring Integrated Senior Living to Hyderabad

News2 days ago

News2 days agoUP RERA Approves 6 Real Estate Projects with Investment Worth ₹864 Crore in 5 Districts