News

Embassy Developments Receives ₹10.6 Billion from Warrant Conversion

Bengaluru/Mumbai, May 23, 2025: Embassy Developments Limited (EDL) has announced the conversion of unlisted warrants into equity shares by the promoter group and another key shareholder.

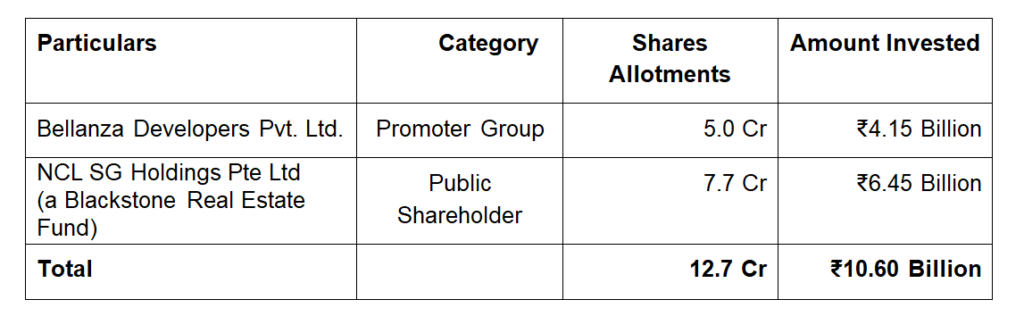

Allotments were made to Bellanza Developers Private Limited (a promoter group entity) and NCL SG Holdings Pvt Limited (a Blackstone Real Estate fund). The transaction has resulted in a capital infusion of INR 10.6 billion, further strengthening the company’s equity base.

The INR 12.7 crore equity shares were allotted upon receipt of the remaining 75 per cent of the issue price (INR 111.51 per share) for the warrants, which were originally issued on May 21, 2024, under a preferential allotment approved by shareholders and rank equally with existing shares.

This equity participation underlines the strong and continued confidence shown by the promoter group and other key shareholders in the growth roadmap of EDL with its substantial pipeline of residential and commercial projects across the country.

Details of Allotment:

Post allotment, the company’s total paid-up equity capital stands at INR 269.9 crore, comprising INR 134.9 crore equity shares of face value INR 2 each.

Revised shareholding of the promoter group stands at 42.96 per cent and Blackstone Real Estate fund at 10.93 per cent. The Company has INR 8.9 crore outstanding warrants pending conversion up to November 2025.

“The INR 10.6 billion raised through warrant conversions by the promoter group and another key shareholder reflects the continued trust in EDL’s vision and growth prospects,” said Sachin Shah, CEO and Executive Director, Embassy Developments Limited.

“This infusion of capital strengthens our balance sheet and ability to scale operations while creating sustained value for all stakeholders. We look forward to capitalising on India’s real estate growth story,”

This conversion is aligned with the company’s previously announced strategic initiatives, including upcoming project launches across 7.7 mn sq ft valued at over INR15,000 crore. The company continues to build a pan-India real estate platform backed by its revitalised Board and leadership team.

News3 weeks ago

News3 weeks agoUnity Group Launches Unity One Elegante Mall at Netaji Subhash Place, Delhi

News2 days ago

News2 days agoMumbai Returns to Pre-Pandemic Investment Levels, Surpasses $1 Billion 4th Consecutive Year: Cushman & Wakefield

News2 days ago

News2 days agoGurugram Premium Segment Drives Projected Rs 6.65 Lakh Crore Market: ANAROCK

News1 day ago

News1 day agoAdani Cement and Coolbrook to Deploy World’s First Commercial Rotodynamic Heater for Cement Decarbonisation

News2 days ago

News2 days agoTIL Ltd Reports Q2 FY26 Results with Enhanced Order Book Position, Strong Execution Momentum

News1 day ago

News1 day agoRobust Demand & New Launches Propel Sri Lotus Developers’ Strong Q2 FY26 Results

News2 weeks ago

News2 weeks agoSerene Communities Announces ₹400 Crore Investment to Bring Integrated Senior Living to Hyderabad

News2 days ago

News2 days agoUP RERA Approves 6 Real Estate Projects with Investment Worth ₹864 Crore in 5 Districts