News

Branded Residences See 12% Annual Growth Amid Global Luxury Boom: SKYE Report

The Global Branded Residence market is growing at a notable pace of 12% per year. It is expanding its footprint in the USA, Thailand, UAE, Portugal, Greece, UK, Brazil, Vietnam, etc. Resurgence in luxury travel, growing propensity to own lifestyle assets, and perception of real estate as a safe haven is driving the trend, a report by SKYE Hospitality said.

Other factors such as relocation and kid’s education, are also contributing to the growth. From Waldrof Astoria in New York to Standard Residence (Phuket) to Mayfair Park residence in London, branded residences are proliferating in affluent neighbourhoods. India can also become one of the epicentres of branded residences, the report adds.

As per the SKYE Hospitality report, India has the potential to become an attractive destination for Branded Residences. While India already enjoys a sizable supply line of 2900 units (~10% of the global market supply of Branded Residence), there is more headspace for the niche but fast-growing luxury segment to thrive.

Already big branded cutting across both hospitality and non-hospitality have ventured in the segment. Some of the notable names include Yoo, Trump, Versace, IHCL, Leela, Four Seasons, Atmosphere Core, Marriott, Oberoi, etc.

“Despite a sizable growth in the Branded Residence in recent years, what we have observed is just a tip of the iceberg. India has tremendous untapped potential to capitalize on. Average HNI Indians are spending generously on an aspirational lifestyle, which will unravel a big market for Branded Residences. Interestingly, the trend will be no more limited to Big metros but will also percolate to tourist destinations and Tier-2 cities,” stated Ankit Kansal, MD, SKYE Hospitality.

Besides strong demand due to rise in well-heeled affluent households, India also offers a tremendous cost advantage. As per the study by SKYE, average prices of Branded Residences in London, Miami, and New York are to the tune of Rs 39.5, Rs 20.3 and Rs 60.2 crore respectively. Average ticket sizes in other emerging cities such as Dubai (Rs 13.5 crore), Athens (Rs 17.9 crore), Phuket (Rs 10.5 crore) are also high. In contrast, the average ticket size of branded homes in India is around Rs 9 crore with enough space for lower ticket brackets as well (Rs 6-7 crore).

“Rich Indians are one of the key growth drivers in international property markets such as Dubai, Singapore, London, Athens, etc. Now with exclusive spaces available and aspirational living available at their own backyard, many will now turn attention inwards rather than going cross-border,” Kansal added.

News1 day ago

News1 day agoMumbai Returns to Pre-Pandemic Investment Levels, Surpasses $1 Billion 4th Consecutive Year: Cushman & Wakefield

News3 weeks ago

News3 weeks agoUnity Group Launches Unity One Elegante Mall at Netaji Subhash Place, Delhi

News2 days ago

News2 days agoGurugram Premium Segment Drives Projected Rs 6.65 Lakh Crore Market: ANAROCK

News2 days ago

News2 days agoTIL Ltd Reports Q2 FY26 Results with Enhanced Order Book Position, Strong Execution Momentum

News2 weeks ago

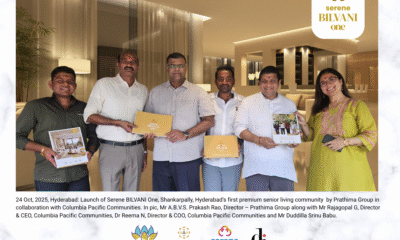

News2 weeks agoSerene Communities Announces ₹400 Crore Investment to Bring Integrated Senior Living to Hyderabad

News20 hours ago

News20 hours agoAdani Cement and Coolbrook to Deploy World’s First Commercial Rotodynamic Heater for Cement Decarbonisation

News1 day ago

News1 day agoUP RERA Approves 6 Real Estate Projects with Investment Worth ₹864 Crore in 5 Districts

News1 day ago

News1 day agoHiranandani Forays into Senior Living, to Develop 1 MSF at Oragadam, Chennai