News

Delhi-NCR tops Housing Price Index for September 2024

New Delhi, December 23, 2024: Property values in India’s National Capital Region (NCR) have shown significant increase in a rather short period. According to the latest findings of the Housing Price Index (HPI), a leading indicator of price trends in India’s key realty markets, the NCR, with an HPI reading of 178, has outperformed its peers, primarily driven by strong end-user demand, investor interest and significant value appreciation in key micro-markets such as New Gurgaon, Noida Extension and Dwarka Expressway.

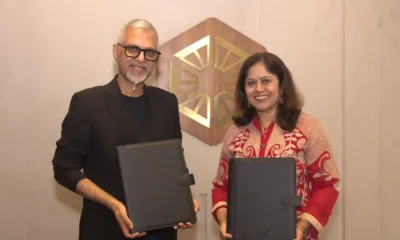

Developed jointly by leading real estate app Housing.com and global business school Indian School of Business (ISB), the HPI serves as a tool that tracks changes in residential home prices across India’s 13 major markets.

The All-India HPI reached 128 in September, marking a 2-point quarter-on-quarter increase, reflecting steady growth in property values across major residential hubs. These findings reaffirm the strength of India’s residential real estate market, as it navigates global and domestic challenges while responding to evolving buyer needs, the report notes.

Other cities that have displayed significant improvement in price growth include Bengaluru and Kolkata. Demand-driven growth in micro-markets such as Varthur and Devanahalli triggered value growth in India’s IT capital: the city saw its reading jump 12 points, from 155 to 167, from June to September. The reading for Kolkata showed a similar jump, from 138 to 150 in the same period.

“With an improvement in infrastructure and connectivity, Kolkata is gradually showing improvements in terms of liveability. Despite a sharp price rise, the city remains more affordable than other metros, providing it a certain edge, especially to people looking for post-retirement homes,” says the report.

Chief Revenue Officer, Housing.com, Amit Masaldan said: “Delhi-NCR’s remarkable performance in the Housing Price Index is a testament to the region’s strong fundamentals, underpinned by robust demand and strategic developments in key micro-markets. This growth aligns with India’s broader real estate trajectory, where rising property values reflect a stable and maturing market. Despite affordability challenges, end-users and investors are demonstrating confidence, driven by the promise of long-term value creation.”

Demand Pushes Price Growth for Larger Homes

According to the report, a sustained preference for larger homes remains a defining trend for India’s real estate sector, with 3BHK configurations maintaining their appeal and 2BHK units witnessing the sharpest price growth.

While the all-India HPI reading for 3BHK homes remains the highest at 136 points, leaping 5 points since June, 2BHK configuration recorded a slightly sharper jump of 7 points to settle at 133 points, the report said.

“The reading for 1BHK homes showed a 6-point drop, from 122 in June to 116 in September. The share of this configuration in overall sales has been declining post-pandemic as more and more people opt for larger homes,” says the report.

News2 weeks ago

News2 weeks agoDN Group Sets National Expansion and IPO Roadmap at DN DAY 2025

News3 weeks ago

News3 weeks agoGulshan Group Partners with Taj to Redefine Branded Living in Noida

News2 weeks ago

News2 weeks agoBPTP Appoints Vineet Nanda as Chief Business Officer

News3 weeks ago

News3 weeks agoDelhi–NCR Malls Roll Out Festive Christmas Celebrations with Lights, Events & Family Activities

News6 days ago

News6 days agoIndian Real Estate in 2025: From Roller-Coaster Rides to Rock-Solid Foundations

News2 weeks ago

News2 weeks agoEmbassy REIT Closes ₹530 Cr Selloff at Embassy Manyata in Bengaluru to EAAA Alternatives’ Real Assets Business

News4 days ago

News4 days agoDanube Group’s Rizwan Sajan to Host Bigg Boss 19 Contestants in Dubai on January 6–7

News2 weeks ago

News2 weeks ago2025 Set the Base: What India’s Real Estate Momentum Signals for 2026