News

Golden Growth Fund, Grovy India Invest in 3 Projects worth ₹180 crore in South Delhi

New Delhi, May 29, 2025: Golden Growth Fund (GGF), a category II south Delhi premium real estate-focused alternative investment fund (AIF), and Grovy India, a BSE-listed south Delhi-based real estate company, have announced investment in three projects worth INR 180 crore in south Delhi, one of India’s premier housing markets.

The investment has been made in Anand Niketan and Neeti Bagh while the third project, in another Category A colony in south Delhi, is expected to come up in the next four months.

The cumulative area of the three projects is approximately 70,000 sq ft. The sales potential of the three projects is around INR 240 crore.

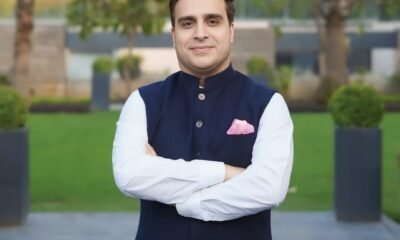

“The investment in south Delhi reiterates our commitment to developing and delivering high-quality projects and a safe and stable 20 per cent plus IRR to our investors,” said Ankur Jalan, CEO, GGF.

“The non-volatile nature of the south Delhi real estate market has led to increased investment with discerning buyers looking to invest in upscale neighbourhoods with homes that offer state-of-the-art amenities and privacy.”

He added, “To add to it, excellent connectivity to the airport and prime office destinations in Delhi-NCR make it a lucrative destination. As a result, the past few years have seen increased redevelopment in prime south Delhi colonies and exceptional price appreciation.”

South Delhi has around 18,500 privately owned residential plots, categorised as A, B, C, and others by MCD, with a market value of INR 5.65 lakh crore, presenting a huge opportunity for project development.

The average price of plots in Category A colonies ranges from INR 7-15 lakh per sq yd while the average price in Category B colonies ranges from INR 6-12 lakh per sq yd.

“The Fund has received a very good response. GGF is the only fund focused on the south Delhi real estate market, which gives us the first-mover advantage in this vast landscape of south and Lutyens Delhi,” he further added.

GGF launched a real estate-focused AIF in September 2024 with a commitment to raise INR 400 crore to acquire land in south and Lutyens Delhi, making it the only fund to invest in this end-user, niche and lucrative real estate market.

Grovy India was established in 1985 and has developed and delivered over 100 luxury projects in south Delhi.

-

News4 weeks ago

News4 weeks agoUnion Budget 2026: Infrastructure-Led Growth Sets Stage for Real Estate Expansion Beyond Metros

-

News4 weeks ago

News4 weeks agoNCDRC Directs District Magistrate to Take Over Control of Much Delayed Greater Noida Project

-

News4 weeks ago

News4 weeks agoBudget 2026 Positions Tourism & Hospitality as Economic Multiplier, Not Support Sector

-

News3 weeks ago

News3 weeks agoJewar Airport ‘Ready’, Likely to Be Inaugurated by PM Modi By Late Next Month

-

News7 days ago

News7 days agoHiranandani Communities Launches Watersports Centre at Premium Coastal Hiranandani Sands, Alibaug Township

-

News5 days ago

News5 days agoStrategic Partnership between Brigade Group, Primus Senior Living to Develop Senior Living Communities

-

News4 weeks ago

News4 weeks agoAshiana Care Homes & Epoch Elder Care Partner to Strengthen Assisted Living & Specialized Senior Care in India

-

Interviews3 weeks ago

Interviews3 weeks agoFrom Square Footage to Soul: Redefining the Urban Living Ecosystem