News

Housing Prices Remain Flat for 3rd Straight Month in March 2025

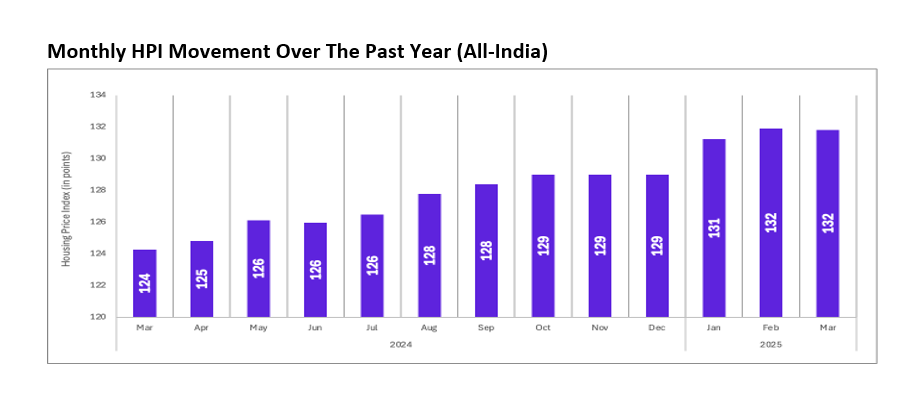

New Delhi, August 5, 2025: Housing prices remained stagnant for the third consecutive month in March, marking a period of price moderation amid macroeconomic uncertainty and supply-side constraints.

However, on an annual basis, the Housing Price Index (HPI) from housing.com and the Indian School of Business (ISB) shows a moderate eight-point increase for FY25 (April 2024–March 2025), closing at 132. This reflects enduring buyer confidence in residential real estate—the most preferred asset class for Indian consumers.

The HPI, a joint initiative by leading digital real estate platform housing.com, owned by REA India and the Indian School of Business (ISB), tracks housing trends across 13 cities: Ahmedabad, Bengaluru, Chennai, Faridabad, Gandhinagar, Ghaziabad, Greater Noida, Gurugram, Hyderabad, Kolkata, Mumbai, Noida and Pune.

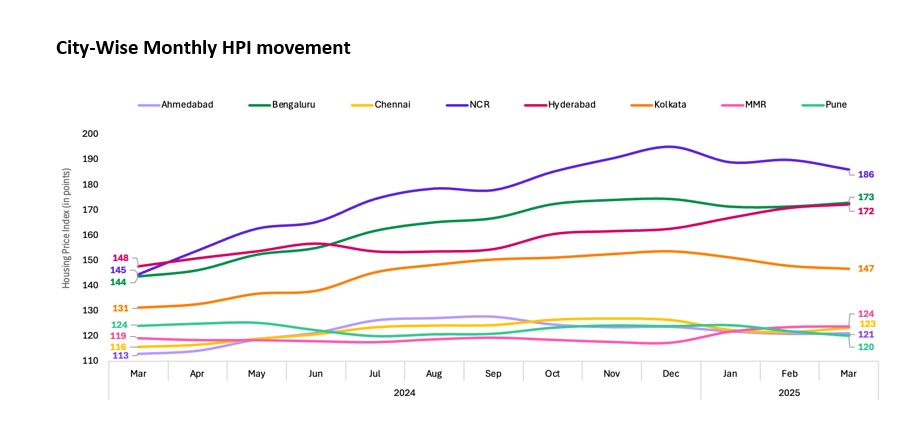

Cities such as Delhi-NCR, Bengaluru and Hyderabad saw substantial year-over-year increases while others showed more moderate or stabilising trends, signalling a maturing real estate cycle.

“The housing market is in a phase of healthy consolidation. After an extended period of price escalation across major cities, we are now seeing a welcome stabilisation in values. This price stagnation, while reflective of cautious market sentiment and supply-side adjustments, is also laying the foundation for more sustainable growth,” said Praveen Sharma, CEO, REA India (housing.com)

“We expect this trend to continue in the near term, which could encourage more end-users—particularly those priced out during the recent bull run—to return to the market. At the same time, with improving affordability due to recent rate cuts and strong underlying demand drivers such as income growth and lifestyle aspirations, we remain optimistic about the long-term resilience of the housing sector.”

Shekhar Tomar, Assistant Professor of Economics and Public Policy, ISB said, “The current price stability points to a more mature and balanced housing market—moving beyond speculative surges and aligning with long-term fundamentals.”

Even amid global uncertainties, steady demand across cities reflects rising incomes, shifting lifestyle priorities and growing end-user confidence, he added. “From Delhi-NCR to Bengaluru and Ahmedabad, this broad-based momentum highlights the economic resilience underpinning residential real estate in India.”

National Trends and Key Drivers

The price stabilisation in early 2025 reflects an interplay of global headwinds, cautious buyer sentiment and reduced launches. However, demand fundamentals remain strong driven by income growth, evolving lifestyle aspirations and the shift to hybrid work models.

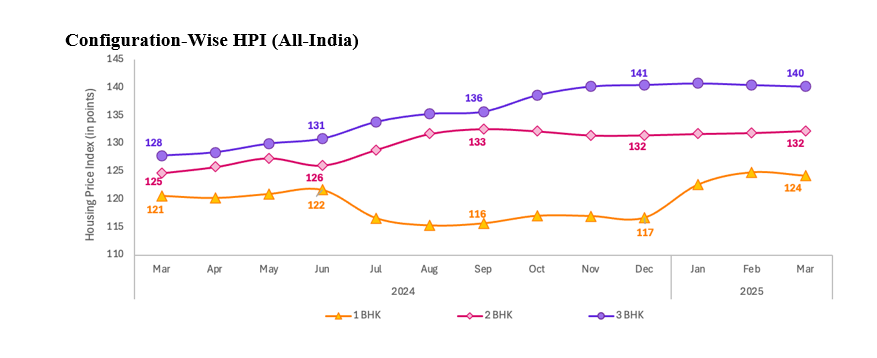

Notably, demand for larger homes is rising—evident from a 12-point jump in the HPI for 3BHK units in March. Meanwhile, 2BHK homes continue to be a steady preference among urban middle-class buyers with the index at 132.

Regional Highlights (Jan–Mar 2025 vs Mar 2024)

● Delhi-NCR saw the sharpest surge with a 42-point jump driven by robust investor interest in premium corridors, despite affordability pressures. 2BHK and 3BHK homes remain dominant.

● Bengaluru registered a 29-point annual rise but showed price stabilisation in recent months. Notably, 1BHK units surged from 176 to 217, indicating configuration recalibration amid high prices.

● Hyderabad climbed 25 points annually with the highest QoQ gain, indicating strong but cooling growth. Demand is shifting to compact formats following sustained price hikes.

● Ahmedabad saw its HPI rise from 113 to 121, led by affordable 1BHK homes, driven by growing job opportunities and investor interest in rent-yielding assets.

● Chennai posted a mild eight-point YoY rise, but a three-point QoQ dip suggests a cooling-off period. Buyers are gravitating towards 1BHK units with 3BHKs seeing the least traction.

● Kolkata witnessed a 15-point gain, reflecting healthy but modest appreciation. 1BHKs dominate preference, aligning with affordability and space constraints in the city.

● MMR, India’s costliest market, recorded a subdued five-point annual rise due to a high-base effect. However, demand for 1BHKs—still the most viable option for many—remains robust.

● Pune was the only market to see an HPI dip, down four points YoY and QoQ amid IT sector uncertainties. Yet, demand for premium 3BHK homes remains resilient among serious buyers.

Outlook for 2025–26

After a period of rapid appreciation, housing prices are expected to moderate further in the coming quarters due to high base effects and improving supply across markets. While price growth may slow, sales momentum is likely to remain positive—especially as market fundamentals stabilise and speculative activity wanes.

Recent monetary policy moves are poised to bolster this outlook. The RBI’s recent 50-basis-point rate cut, which makes it over 100 basis points in the last three MPS meetings, is likely to push home loan interest rates below eight per cent, enhancing affordability.

However, access to affordable housing remains a structural challenge amid rapid urbanisation. While premium housing continues to thrive, catering to the aspirations of high-income consumers, expanding availability in the budget and mid-range segments will be key to ensuring sustainable growth in the long term.

-

News4 weeks ago

News4 weeks agoBudget 2026 Positions Tourism & Hospitality as Economic Multiplier, Not Support Sector

-

News3 weeks ago

News3 weeks agoJewar Airport ‘Ready’, Likely to Be Inaugurated by PM Modi By Late Next Month

-

News1 week ago

News1 week agoHiranandani Communities Launches Watersports Centre at Premium Coastal Hiranandani Sands, Alibaug Township

-

News5 days ago

News5 days agoStrategic Partnership between Brigade Group, Primus Senior Living to Develop Senior Living Communities

-

News4 weeks ago

News4 weeks agoAshiana Care Homes & Epoch Elder Care Partner to Strengthen Assisted Living & Specialized Senior Care in India

-

Interviews3 weeks ago

Interviews3 weeks agoFrom Square Footage to Soul: Redefining the Urban Living Ecosystem

-

News2 weeks ago

News2 weeks agoSambhav Homes Completes 85-acre Land Delivery for ₹600-Cr ESR Hosur Advanced Manufacturing Park

-

News3 weeks ago

News3 weeks agoNew Training and Certification System Implemented for Real Estate Agents in Uttar Pradesh