News

HSIL Financial Results

Excellent Q1 performance by HSIL Limited

|

Highlights |

|

Revenue from Operations grew by 15.09% |

|

Profit after tax (PAT) up 36% |

|

Building Products Net Sales up by 23.30% |

|

Packaging Products recorded a EBIT growth of 40.88% |

|

Excellent performance by Consumer Products Business |

New Delhi, August 10, 2016: HSIL Limited, a leading building products company and second biggest in packaging products (Container Glass and PET), announced its results with strong performance of its overall business for the quarter ending June 2016.

The company’s revenues from operation in Q1 of FY’16-17 grew to INR 499 Cr, representing growth of 15.09% over INR 433 Cr in the corresponding quarter in last fiscal. Operating profit (EBITDA) of the company increased by 13.56% to INR 75.46 Cr from INR 66.45 Cr. Profit after taxes of the company of INR 26.48 Cr grew by 36% over previous year corresponding figure of INR 19.47 Cr.

The Building Products Division as well as Packaging Products Division has shown excellent growth during the quarter both in terms of Sales and profitability. The net sales of building products division grew to INR 237.12 Cr. representing growth of 23.30%over previous year corresponding figures and the packing product division profits improved by 40.88% over previous year figures.

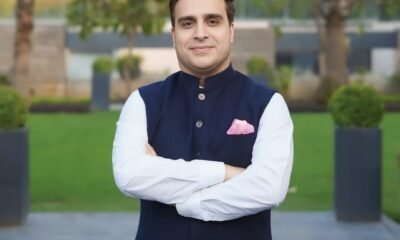

Mr. Sandip Somany, Jt. Managing Director, HSIL, said, “With consumers at the core of our strategic charter, we started off the year with exceptional performance from our Building Products Division. The decision to foray into Consumer Products business has started paying dividends as the products are being well appreciated in the market. This has led us to optimistically target 10,000 retail points for consumer business in the next 2-3 years. With both sanitary ware demand growing and a positive outlook of the Consumer Products Business, we anticipate FY 16-17 to deliver results as per our targets.

The improved profitability of the Packaging Products Division is an outcome of our tactical and innovative steps taken to garner an edge in the glass packaging market and has further boosted the overall performance of the Company.

The signs of positivity are well defined and clearly visible. With a better financial leverage position, planned capacity expansion of existing businesses, calculated foray into new businesses (CPVC & UPVC and Security Caps & Closures) and low long term debt, the Company is poised to take a big leap of growth.

-

News4 weeks ago

News4 weeks agoJewar Airport ‘Ready’, Likely to Be Inaugurated by PM Modi By Late Next Month

-

News1 week ago

News1 week agoHiranandani Communities Launches Watersports Centre at Premium Coastal Hiranandani Sands, Alibaug Township

-

News7 days ago

News7 days agoStrategic Partnership between Brigade Group, Primus Senior Living to Develop Senior Living Communities

-

News4 weeks ago

News4 weeks agoAshiana Care Homes & Epoch Elder Care Partner to Strengthen Assisted Living & Specialized Senior Care in India

-

News2 weeks ago

News2 weeks agoSambhav Homes Completes 85-acre Land Delivery for ₹600-Cr ESR Hosur Advanced Manufacturing Park

-

Interviews3 weeks ago

Interviews3 weeks agoFrom Square Footage to Soul: Redefining the Urban Living Ecosystem

-

News4 weeks ago

News4 weeks agoNew Training and Certification System Implemented for Real Estate Agents in Uttar Pradesh

-

News7 days ago

News7 days agoFY27 Outlook Residential Real Estate: High Base and Affordability Challenges; Tier I Mid-Premium Segment Resilient