News

Infra-led recovery is underway in global construction: RICS

Global professional body RICS released its Q4 2020 analysis on February 9. According to RICS’ latest Global Construction Monitor, there are clear signs that a global rebound is now underway in the construction market despite the lingering macroeconomic impact of .

However, expectations for future growth depend heavily on infrastructure projects, while rising costs and pressures on profits may slow momentum.

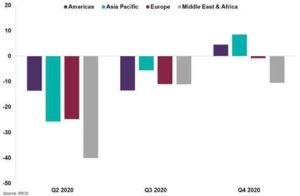

RICS Global Construction Activity Index, a measure of current and expected construction market conditions among construction professionals, returned to positive territory in Q4. It rose to +3, signifying the market’s return growth, and up from -9 in Q3 and -24 in Q2. Looking ahead, there was broad-based increased optimism for workloads over the next twelve months, with expectations for work in the Philippines, United States, Saudi Arabia and New Zealand pointing to a particularly robust rebound.

The trend of modest growth was not uniform across all regions, however. The strongest results were seen in the Americas (+5) and APAC (+8), with respondents noting an increase in aggregate workloads. However, there is a more mixed picture in Europe (-1) and MEA (-10), where sentiment in Spain, Turkey and South Africa was notably weaker.

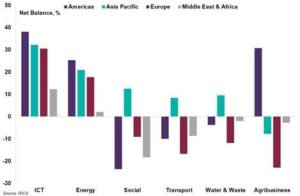

Infrastructure leading recovery, driven by global growth in ICT and energy sectors

Infrastructure projects have been central to the construction sector’s return to growth. In particular, information and communication technology (ICT) and energy projects continued to increase from Q3 into Q4, with both sectors now growing at pace at a global level. This trend was particularly pronounced in the Americas, where respondents reported a net balance of +38% in ICT and +25% in energy.

Professionals believe infrastructure will be at the forefront of the wider recovery of the sector over the next twelve months, reflecting the huge scale of fiscal stimulus already underway or expected from governments in many countries in their policy response to the pandemic. Professionals from 24 of the 30 countries surveyed expect infrastructure workloads to grow in the next twelve months. Respondents in just four countries expect infrastructure workloads to shrink.

Sean Ellison, Senior Economist, said, “The building blocks for recovery are being put into place, with construction activity growing once more on the back of concerted infrastructure investment and rising optimism.

“Despite the early signs of recovery challenges remain. Whilst construction will play a vital role in wider global economic recovery, the sector’s recovery is not yet entrenched – nor is it universal across countries. With infrastructure a key driver in leading this bounce back, greater government spending will be vital. Many governments have committed to substantial infrastructure spending, bringing forward shovel-ready projects and we can expect more fiscal stimulus. How effectively this capital is put to use will dictate the speed of our recovery”

Alan Muse, Head of Construction Standards, RICS, said, “Using effective and timely infrastructure stimulus measures to rejuvenate the economy is never straightforward. New build infrastructure schemes are invariably complex with long gestation periods. Concentrating on quick wins in the repair and maintenance of infrastructure may have a more immediate impact on the market and a quicker multiplier effect. In addition, fiscally constrained governments need to attract more private sector investment into this sector and de-risking projects through the application of standards to improve reporting, data collection and predictability is crucial.

Alan Muse, Head of Construction Standards, RICS, said, “Using effective and timely infrastructure stimulus measures to rejuvenate the economy is never straightforward. New build infrastructure schemes are invariably complex with long gestation periods. Concentrating on quick wins in the repair and maintenance of infrastructure may have a more immediate impact on the market and a quicker multiplier effect. In addition, fiscally constrained governments need to attract more private sector investment into this sector and de-risking projects through the application of standards to improve reporting, data collection and predictability is crucial.

“Transparent and prioritised pipelines of implementable design and construction work are key to attracting private sector investment from pension funds: comparing pipelines of projects on a common datum basis using international standards will ensure a consistent and more meaningful approach.”

“As global economies recover from the effects of the pandemic, inevitably extended supply chains may struggle to keep up with demand leading to higher material and labour cost inflation. Although this inflationary effect may be short-lived, there is no doubt that in some markets this could act as a dampener on demand and/or lead to escalation disputes. Again, thorough scenario planning and prediction at construction initiation, will allow these risks to be properly identified, mitigated and managed.”Alan Muse added.

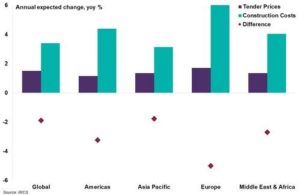

Challenges remain with rising construction costs

Whilst the outlook for overall workloads throughout 2021 is positive, business conditions in the construction industry are expected to remain difficult. Profits remain under pressure, with tender prices expected to rise less rapidly than construction costs in all regions.

Nonetheless, as sentiment improves, there is a modest expansion in headcounts expected globally. The optimistic outlook for headcounts is driven by APAC, with hiring expected to resume in 2021, a notable shift in market sentiment from Q3 where most respondents were expecting further reductions in headcounts over the following twelve months.

-

News4 weeks ago

News4 weeks agoMumbai’s Largest Trimandir Opens in Thane with Grand Three-Day Pran-Pratistha Ceremony

-

News4 weeks ago

News4 weeks agoBudget 2026: Real Estate Sector Awaits Real Reform, Targeted Relaxations For Boost

-

News4 weeks ago

News4 weeks agoUnion Budget 2026: Infrastructure-Led Growth Sets Stage for Real Estate Expansion Beyond Metros

-

News4 weeks ago

News4 weeks agoNCDRC Directs District Magistrate to Take Over Control of Much Delayed Greater Noida Project

-

News4 weeks ago

News4 weeks agoBudget 2026 Positions Tourism & Hospitality as Economic Multiplier, Not Support Sector

-

News3 weeks ago

News3 weeks agoJewar Airport ‘Ready’, Likely to Be Inaugurated by PM Modi By Late Next Month

-

News4 weeks ago

News4 weeks agoAIPL Acquires 43-Acre Gurugram Land for ₹1,000 Cr Through DRT

-

News4 weeks ago

News4 weeks agoAshiana Care Homes & Epoch Elder Care Partner to Strengthen Assisted Living & Specialized Senior Care in India