Report

JLL India releases new report ‘real estate private equity 3.0’

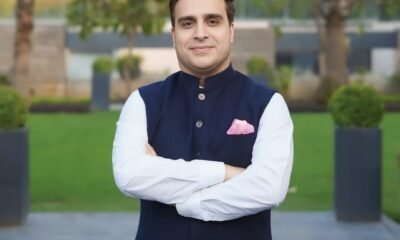

Leading international real estate consultancy JLL India has released its latest research on the Indian real estate sector, dealing with how private equity (PE) into the country’s property sector has changed over the years – and the current status on this front. The report ‘Real Estate Private Equity 3.0’ points out that PE players are now raising funds for specific real estate asset classes like residential, unlike the earlier modus operandi of raising diversified funds.

Anuj Puri, Chairman & Country Head, JLL India says, “There has been a clear increase of focus among investors about where they want to invest their funds in. During 2007-08, investors left no stone unturned to participate in India’s economy and real estate growth story, and invested across all possible asset classes. In the same period, 66 pc of funds were diversified. The share of such funds has reduced to negligible levels, post-2014. In contrast, residential-focused funds have increased to 85 pc today from the then measly figure of 14 pc. These two trends show that the investment approach of investors has changed from weighing every asset class on the opportunity it presented to becoming residential-focused, as this asset class has given maximum returns over the years.”

Investment activities pick up

From 2014, Indian real estate has witnessed PE investments worth USD 2.2 billion. This is even before taking into consideration platform level deals which are worth USD 2 billion. When we compare the quantum of activities in last 18 months to investments between 2009 and 2013 that were worth USD 3.9 billion, this uptick is clearly evident. Per year investment has increased by two times.

As PE funds mature, they become selective

Between 2005 and 2008, investments were not only seen across all real estate asset classes but investors also invested in Tier-II and Tier-III cities. As many as 30 Indian cities enjoyed investment during this phase. Post this phase, however, the selection criteria has gotten stricter and due diligence has increased – displaying a maturing of India’s real estate PE industry.

From 2014, it is largely the developers with very good track record that have managed to attract investments. At the same time, investors have restricted themselves to seven-eight cities only and a considerable portion of investment has gone into residential and office assets – showcasing a clear focus among the investors.

-

News4 weeks ago

News4 weeks agoJewar Airport ‘Ready’, Likely to Be Inaugurated by PM Modi By Late Next Month

-

News4 weeks ago

News4 weeks agoBudget 2026 Positions Tourism & Hospitality as Economic Multiplier, Not Support Sector

-

News1 week ago

News1 week agoHiranandani Communities Launches Watersports Centre at Premium Coastal Hiranandani Sands, Alibaug Township

-

News6 days ago

News6 days agoStrategic Partnership between Brigade Group, Primus Senior Living to Develop Senior Living Communities

-

News4 weeks ago

News4 weeks agoAshiana Care Homes & Epoch Elder Care Partner to Strengthen Assisted Living & Specialized Senior Care in India

-

News2 weeks ago

News2 weeks agoSambhav Homes Completes 85-acre Land Delivery for ₹600-Cr ESR Hosur Advanced Manufacturing Park

-

Interviews3 weeks ago

Interviews3 weeks agoFrom Square Footage to Soul: Redefining the Urban Living Ecosystem

-

News4 weeks ago

News4 weeks agoNew Training and Certification System Implemented for Real Estate Agents in Uttar Pradesh