News

L&T Posts 21% Revenue Growth in Q2, Order Book Hits Record High of Rs 510,402 Crore

Mumbai / November 1, 2024: L&T reported strong Q2 results, with revenue surging 21% year-over-year to Rs 61,555 crore, driven by accelerated Projects & Manufacturing activities. International revenue continued to be a major contributor, accounting for 52% of the total revenue. For the first half of the year, the company recorded an 18% year-over-year revenue growth, reaching Rs 116,674 crore, with international revenue making up 50% of the total. Net profit after tax (PAT) also saw growth, increasing by 5% year-over-year to Rs 3,395 crore for the quarter and 8% to Rs 6,181 crore for the first half, a statement from the company said.

L&T’s adjusted PAT witnessed robust growth, excluding a one-time gain in the previous year, with a 25% increase in Q2 and 19% in H1. While Q2 orders reached Rs 80,045 crore, reflecting a 13% sequential growth, a 10% year-over-year decline was observed due to high-value orders in the prior year. International orders continued to be a significant driver, accounting for 63% of the total order inflow in Q2 and 55% in H1, spanning sectors like Renewables, Urban Transit, Nuclear, and Offshore Hydrocarbon. As of September 30, 2024, the company’s order book stood at Rs 510,402 crore, a 7% growth from March 2024, with 40% of orders originating internationally, the statement added.

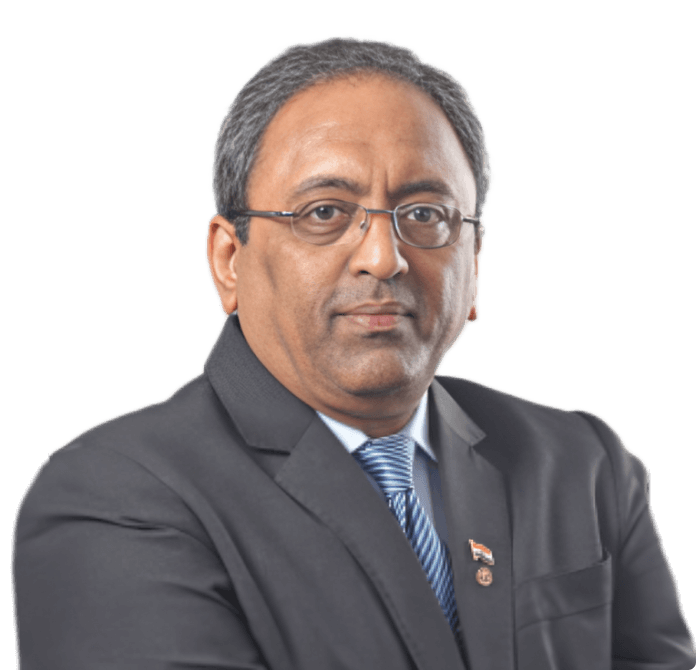

S.N. Subrahmanyan, Chairman and Managing Director of Larsen and Toubro (L&T), stated, “We have delivered yet another quarter of strong financial performance despite the continuing global macro economic volatility. The projects & manufacturing businesses of the Company continue to perform well. We have a record order book ₹ 5 lakh crore+ that is a testimony of our proven competence in the domains of engineering, construction, manufacturing, and project management. Our new transformative investments in Green Energy, Data Centers, Digital Platforms and Semiconductor Design will, besides improving our Digital and Sustainability footprint, compliment our current business portfolio as well. India’s growth story remains intact on the back of continued public capex spends and a visible recovery in private investments as well. We expect the Middle East Capex momentum to remain healthy. The Company remains committed on delivering a sustained performance of growth.”

-

News4 weeks ago

News4 weeks agoMumbai’s Largest Trimandir Opens in Thane with Grand Three-Day Pran-Pratistha Ceremony

-

News4 weeks ago

News4 weeks agoBudget 2026: Real Estate Sector Awaits Real Reform, Targeted Relaxations For Boost

-

News4 weeks ago

News4 weeks agoUnion Budget 2026: Infrastructure-Led Growth Sets Stage for Real Estate Expansion Beyond Metros

-

News4 weeks ago

News4 weeks agoNCDRC Directs District Magistrate to Take Over Control of Much Delayed Greater Noida Project

-

News4 weeks ago

News4 weeks agoBudget 2026 Positions Tourism & Hospitality as Economic Multiplier, Not Support Sector

-

News3 weeks ago

News3 weeks agoJewar Airport ‘Ready’, Likely to Be Inaugurated by PM Modi By Late Next Month

-

News4 weeks ago

News4 weeks agoAIPL Acquires 43-Acre Gurugram Land for ₹1,000 Cr Through DRT

-

News5 days ago

News5 days agoHiranandani Communities Launches Watersports Centre at Premium Coastal Hiranandani Sands, Alibaug Township