News

More capital from insurance, pension funds needed to drive real estate growth in India: Anshuman Magazine

Anshuman Magazine, Chairman & CEO – India, South-East Asia, Middle East & Africa, CBRE

New Delhi, February 16, 2026: While institutional investment into the Indian real estate has gone up significantly in the last few years, the sector would require more long-term financing from sources like insurance firms and sovereign funds as the economy grows, Anshuman Magazine, Chairman & CEO – India, South-East Asia, Middle East & Africa, CBRE, said on Saturday.

He was speaking in a fireside chat at the ET NOW Global Business Summit 2026 on ‘India’s Built Future: The Multi-Asset Playbook for 2030’.

“Globally, a large part of real estate is financed by insurance firms, sovereign funds, and endowment funds. That is not happening enough in India,” said Magazine. “If you look at pension funds, a huge amount of money is just sitting there. A certain percentage of that capital must flow into real estate.”

The capital inflows in the real estate sector hit an all-time high of $14.3 billion in 2025 but most of the investments continued to come from domestic developers and foreign private equity. Allocation from pension and insurance funds is likely to provide the “patient capital” necessary for large-scale, long-gestation infrastructure and commercial projects.

Magazine said that apart from institutional money and the public markets, Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs) would also play a larger role in India’s evolving real estate landscape. With over 135 million sq. ft. of office space already listed, he predicted a significant diversification of the asset class.

“Going forward, we will see REITs expanding into logistics, hospitality, and healthcare sectors,” he added. “The rapid growth of e-commerce, and expansion of healthcare real estate beyond hospitals to pathology labs etc., may offer investors a diversified yield play beyond the traditional commercial spaces.”

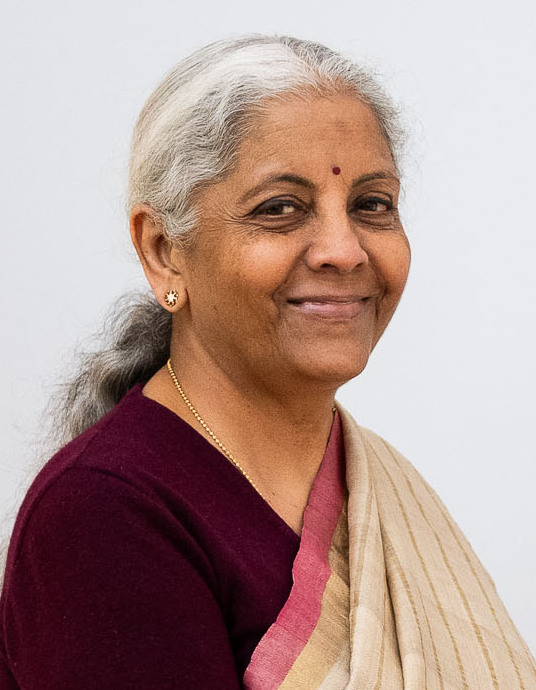

REITs have also received significant push from the government and the Reserve Bank of India. In her Budget 2026 speech earlier this month, Finance Minister Nirmala Sitharaman said that the government would accelerate the “recycling” of real estate assets owned by Central Public Sector Enterprises (CPSEs) through dedicated REIT structures.

Later, the central bank proposed allowing commercial banks to lend directly to REITs at the trust level. This is expected to come into effect from July this year. Previously, banks could only lend to the individual Special Purpose Vehicles under REIT, which was a relatively expensive process.

In the fireside chat, Magazine also pointed out that the office continues to be a high-growth sector in the Indian real estate. “India will cross 1 bn. sq. ft. of office space this year. It has never happened before,” he said. In 2025, office leasing in India reached a record high for the third consecutive year, touching 82.6 million sq. ft.”

Magazine further linked real estate development directly to national productivity. He said that for India’s young workforce to remain competitive, urban centers must evolve beyond mere “work hubs”.

“We have one of the youngest populations in the world. For that population to remain focused and productive, we need to prioritize ‘ease of living’. This means better connectivity, affordable housing, and vibrant entertainment hubs. If we want to attract and retain the best talent, we must provide urban centers where they can perform,” he said.

He also highlighted the rising importance of smaller cities in India. “In the last five years, the amount of activity that is happening in the tier-2 and 3 towns is unprecedented. There is no doubt the future will be in these cities,” Magazine emphasised.

-

News2 weeks ago

News2 weeks agoMumbai’s Largest Trimandir Opens in Thane with Grand Three-Day Pran-Pratistha Ceremony

-

News2 weeks ago

News2 weeks agoBudget 2026: Real Estate Sector Awaits Real Reform, Targeted Relaxations For Boost

-

News4 weeks ago

News4 weeks agoVianaar Homes Earns Great Place to Work® Certification in India

-

News2 weeks ago

News2 weeks agoUnion Budget 2026: Infrastructure-Led Growth Sets Stage for Real Estate Expansion Beyond Metros

-

News4 weeks ago

News4 weeks agoCommercial Leasing Trends Evolve to Keep Pace with Development in Noida, Greater Noida

-

News4 weeks ago

News4 weeks agoRASA Group Introduces AVANI Infratech, Focused on Residential, Commercial and Industrial Land Assets

-

News2 weeks ago

News2 weeks agoNCDRC Directs District Magistrate to Take Over Control of Much Delayed Greater Noida Project

-

News3 weeks ago

News3 weeks agoHousing.com Expands Footprint to 15 Tier II Cities, Strengthening Presence in Emerging Residential Markets