News

NCW Prime Offices Fund Acquires Prius Platinum in Delhi from Kotak Alternate Asset Managers-Led Consortium

New Delhi, May 27, 2025: Prime Offices Fund (PRIME), a commercial real estate-focussed fund managed by Nuvama and Cushman & Wakefield Management Private Limited (NCW), a joint venture between Nuvama Asset Management Limited and Cushman and Wakefield, announced the acquisition of Prius Platinum, a premium Grade A office space in South Delhi’s Saket District Centre.

The property was acquired from a fund managed by Kotak Alternate Asset Managers Limited-led consortium.

Spanning across 0.3 mn sq ft, the property was acquired by the Kotak consortium through the IBC process in 2021. Since then, it has undergone a comprehensive transformation, including upgrades, ESG initiatives and enhanced operational performance. These concerted efforts have led to an increase in leasing activity.

The transaction marks a significant milestone in the firm’s value-creation strategy and commitment to sustainability-driven investments.

The property is 95 per cent leased. It provides stable rental income with a weighted average lease expiry of five years and in-place lock-in periods, ensuring long-term income stability.

The asset boasts of a marque tenant stack, including leading legal, pharma and financial institutions and other front office tenants. This acquisition reinforces PRIME Fund’s strategy of investing in high-quality office spaces across India’s prime commercial hubs.

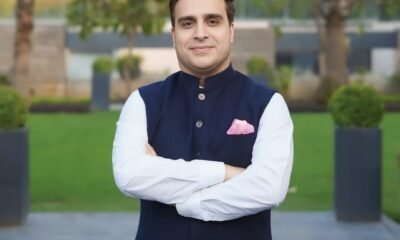

“We are excited to acquire Prius Platinum. This rare, institutionally owned asset perfectly aligns with the Prime Offices Fund’s strategy of creating a high-quality, sustainable, income-generating portfolio,” said Gaurav Puri, CIO, NCW.

“With India’s commercial real estate sector continuing to show strong fundamentals, this acquisition marks an important milestone in delivering world-class investment solutions for our investors.”

Rahul Chhaparwal, Partner, Kotak Alternate Asset Managers Limited, said, “We are proud of the journey this asset has undergone—from acquisition through IBC to a complete revival as a state-of-the-art, ESG-compliant commercial hub. This sale is a testament to the strength of our asset management capabilities and our ability to create long-term value for stakeholders through sustainability-focused strategies.”

-

News4 weeks ago

News4 weeks agoJewar Airport ‘Ready’, Likely to Be Inaugurated by PM Modi By Late Next Month

-

News1 week ago

News1 week agoHiranandani Communities Launches Watersports Centre at Premium Coastal Hiranandani Sands, Alibaug Township

-

News7 days ago

News7 days agoStrategic Partnership between Brigade Group, Primus Senior Living to Develop Senior Living Communities

-

News4 weeks ago

News4 weeks agoAshiana Care Homes & Epoch Elder Care Partner to Strengthen Assisted Living & Specialized Senior Care in India

-

News2 weeks ago

News2 weeks agoSambhav Homes Completes 85-acre Land Delivery for ₹600-Cr ESR Hosur Advanced Manufacturing Park

-

Interviews3 weeks ago

Interviews3 weeks agoFrom Square Footage to Soul: Redefining the Urban Living Ecosystem

-

News4 weeks ago

News4 weeks agoNew Training and Certification System Implemented for Real Estate Agents in Uttar Pradesh

-

News7 days ago

News7 days agoFY27 Outlook Residential Real Estate: High Base and Affordability Challenges; Tier I Mid-Premium Segment Resilient