News

Of 520 mn sq ft, Only 23% of Total REITable Office Stock in Top Cities Listed

Mumbai, June 19, 2025: India was a late entrant into the REIT sector. However, since REITs were launched in 2019, their market capitalisation has surpassed that of some major economies with mature REIT markets.

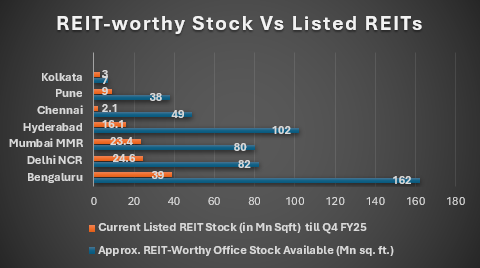

Despite their growth potential, the latest ANAROCK Research data finds that only 23 per cent of the total REIT-worthy office stock, approximately 520 million sq ft (MSF), across the top seven cities is listed in REIT portfolios.

“The three listed Indian REITs—Embassy Office Parks, Mindspace Business Parks and Brookfield India—have a combined portfolio of just 117.2 MSF, just 23 per cent of the overall REIT-able Indian office space market. This indicates significant headroom for future REIT listings and office market consolidation across the top seven cities,” says Anuj Puri, Chairman, ANAROCK Group.

With around 313 MSF, the southern cities of Bengaluru, Hyderabad and Chennai host the maximum available REIT-worthy office stock. However, just 18 per cent of this stock is listed in REIT portfolios:

- Bengaluru has the highest REITable office stock of approximately 162 MSF, of which just 24 per cent, or around 39 MSF, is currently listed under REIT portfolios.

- In Hyderabad, just 16 per cent of a total 102 MSF of REIT-worthy office stock is listed.

- In Chennai, just 4 per cent of 49 MSF REIT-compliant office stock is REIT-listed.

- In north India, Delhi-NCR has a total of REIT-worthy stock of 82 MSF, of which just 30 per cent is listed.

- The top western markets, MMR and Pune, have a combined REITable office stock of 118 MSF, of which just 27 per cent is REIT-listed. MMR has REIT-worthy office stock of about 80 MSF, of which around 23.4 MS (29 per cent) is listed. Of 38 MSF of overall REITable stock in Pune, just 24 per cent is REIT-listed.

- Kolkata has REIT-suitable stock of approximately 7 MSF, of which 43 per cent is already listed.

“Data trends indicate that in 2023, the total REIT-worthy office stock in the top seven cities was approximately 383 MSF,” says Puri. “This has grown by 36 per cent since then to around 520 MSF. Thanks largely to generous new office supply infusions since 2023 and also upgradation of old Grade A office stock to meet current demand and standards.”

ANAROCK data shows that around 106.4 MSF of Grade A office space has been added across the top seven cities from 2023 to Q1 2025. Meanwhile, out of the total available Grade A office stock across the top seven cities (850 MSF), at least, 400 MSF (or 47 per cent) is older than 10 years and can be upgraded to REIT standards. This will not only increase REIT-worthy stock across cities but also help increase office rental premiums by 10-30 per cent.

In terms of appreciation, as of June 16, office REITs have shown strong one-year performance driven by robust leasing activity and steady rental escalations. For instance, Mindspace Business Parks REIT led the pack with a 23.34 per cent annual return, followed by Brookfield India REIT at 15.19 per cent and Embassy Office Parks REIT at 9.17 per cent.

-

News4 weeks ago

News4 weeks agoMumbai’s Largest Trimandir Opens in Thane with Grand Three-Day Pran-Pratistha Ceremony

-

News4 weeks ago

News4 weeks agoBudget 2026: Real Estate Sector Awaits Real Reform, Targeted Relaxations For Boost

-

News4 weeks ago

News4 weeks agoUnion Budget 2026: Infrastructure-Led Growth Sets Stage for Real Estate Expansion Beyond Metros

-

News4 weeks ago

News4 weeks agoNCDRC Directs District Magistrate to Take Over Control of Much Delayed Greater Noida Project

-

News3 weeks ago

News3 weeks agoJewar Airport ‘Ready’, Likely to Be Inaugurated by PM Modi By Late Next Month

-

News3 weeks ago

News3 weeks agoBudget 2026 Positions Tourism & Hospitality as Economic Multiplier, Not Support Sector

-

News4 weeks ago

News4 weeks agoAIPL Acquires 43-Acre Gurugram Land for ₹1,000 Cr Through DRT

-

News3 weeks ago

News3 weeks agoAshiana Care Homes & Epoch Elder Care Partner to Strengthen Assisted Living & Specialized Senior Care in India