News

OFFICE LEASING ACROSS TOP 6 CITIES RISES 7% YOY TO 38.2 MN SQ FT IN H1 2025: SAVILLS INDIA

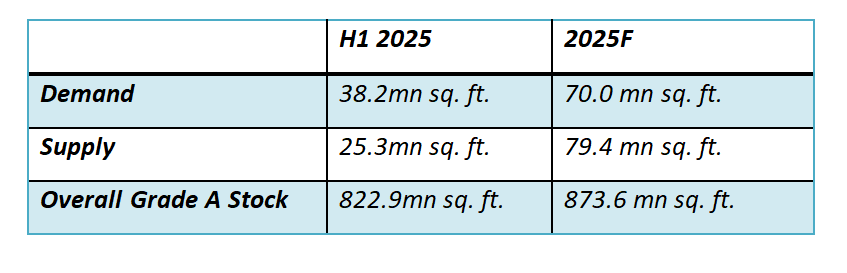

New Delhi, July 22, 2025: Office space absorption across top six major cities stood at 38.2 mn sq ft (MSF) as of June, marking a seven per cent YoY increase, according to International real estate advisory firm Savills India.

New supply saw a significant uptick with 25.3 MSF of completions in H1 2025, representing a 44 per cent YoY growth. Overall vacancy rate at the end of June declined to 14.7 per cent from 15.9 per cent last year. Consequently, total Grade A office stock now stands at 822.9 MSF as of Q2 2025.

Office absorption is projected to exceed 70 MSF in 2025 driven by growing occupier confidence and a strong pipeline of quality supply catering to evolving workplace needs.

It is important to note that the figures presented pertain exclusively to fresh lease transactions and do not include pre-commitments or lease renewals.

Bengaluru, Chennai, Delhi-NCR, Hyderabad, Mumbai and Pune

Key Highlights of H1 2025 for India office market

- India recorded a gross office space demand of 38 MSF in H1 2025, registering a seven per cent annual growth. Leasing activity in Q2 2025 stood at 18.8 MSF, reflecting a marginal decline of three per cent compared to the previous quarter. In contrast, new supply saw a sharp QoQ increase of 94 per cent, reaching 16.7 MSF.

- Bengaluru remained the top contributor to overall office leasing activity, accounting for 27 per cent of the total absorption in H1 2025, followed by Delhi-NCR and Mumbai.

- The technology sector led leasing activity, accounting for 34 per cent of total absorption, followed by the flexible workspaces and BFSI sectors, each contributing 16 per cent, while the engineering and manufacturing sector also emerged as a notable contributor with an 11 per cent share.

- Large deals (100,000 sq ft or more) continued to lead office leasing in H1 2025, contributing 45 per cent to the total transaction volume.

- Global capability centres (GCCs) remained a key demand driver for office space, accounting for nearly 41 per cent of total leasing activity with approximately 16 MSF. Bengaluru, Chennai and Hyderabad collectively recorded approximately 12 MSF of GCC-driven leasing during the period.

CITY-WISE KEY TRENDS

- Bengaluru reinforced its leadership in office market in H1 2025 with 10.4 MSF of gross absorption driven by sustained demand for quality workspaces. GCC’s accounted for nearly 67 per cent of the city’s leasing activity, reflecting continued interest from global firms leveraging the city’s skilled workforce, business ecosystem and steady Grade A supply. Leasing was further supported by strong activity from IT-BPM and engineering and manufacturing occupiers, accounting for around 60 per cent of the total leasing activity.

- Delhi-NCR recorded 6.8 MSF of gross absorption in H1 2025, ranking second after Bengaluru. The IT-BPM and BFSI sectors continued to lead leasing activity, contributing 31 per cent and 21 per cent to the overall volumes, respectively. GCCs remained prominent demand drivers, accounting over 25 per cent of total leasing with several pre-commitments materialising in H1 as new supply reached completion and entered the market.

- Mumbai is the third largest demand market in H1 2025 that recorded as 6.7 MSF in H1 2025. Technology and financial services occupiers together dominated the leasing activity with a cumulative 58 per cent share.

- Chennai registered 5.5 MSF of gross leasing in H1 2025, reflecting a notable 14 per cent YoY increase fuelled by robust demand from occupiers in the IT-BPM, BFSI and flexible workspace sectors. Large deals (100,000 sq ft or more) accounted for 58 per cent of the total activity, highlighting occupiers’ focus on scalable office spaces.

- Hyderabad recorded 4.8 MSF of gross office absorption in H1 2025, reflecting a 20 per cent YoY decline—a sign of temporary slowdown driven by prolonged decision-making cycles and shifting occupier strategies. GCCs remained active, accounting for 50 per cent of the gross leasing with approximately 2.4 MSF of space transacted.

- Pune witnessed a supply infusion of 7.0 mn sq. ft. during H1 2025, marking a 2.4X YOY increase and registering the highest half-yearly supply peak in the past two decades. With the gross absorption reaching 4.1 MSF, GCCs continued their expansion by leasing 0.9 MSF. Notably, BFSI GCCs led this growth, accounting for 61 per cent of total GCC space take-up.

News4 weeks ago

News4 weeks agoMaharashtra Govt and Lodha Developers sign Rs 30K-Crore MoU for Green Integrated Data Centre Park

News4 weeks ago

News4 weeks agoUP RERA launches 20th Real Estate Agent Training Program at Gautam Buddha Nagar

News4 weeks ago

News4 weeks agoHCBS Developments Appoints KBE as Construction Partner for Twin Horizon in Gurugram

News4 weeks ago

News4 weeks agoWehouse Raises ₹25 Crore Series A Funding to Expand Tech-Driven Home Construction Across India

News4 weeks ago

News4 weeks agoRISE Infraventures Strengthens Leadership with Appointment of Ajay Malik as CSO

News4 weeks ago

News4 weeks ago‘Real Estate to Scale up Office and Industrial Assets Beyond 2 Billion Sq Ft By 2047’

News2 weeks ago

News2 weeks agoSpectrum@Metro Brings Biggest Dandiya Night to Noida on September 27

News4 weeks ago

News4 weeks agoIndia’s Logistics & Industrial Leasing Hits 30.7 MSF in H1 2025; Poised to Cross 60 MSF by Year-End: Cushman & Wakefield