News

Zuari Industries Reports Exceptional Turnaround in Second Quarter Results

Gurugram, November 13, 2025: Zuari Industries Limited announced its unaudited financial results for the quarter ended September 30, 2025. On a standalone basis, the Company reported total Revenue of INR 248.1 crore for Q2 FY26 and INR 472.8 crore for H1 FY26. EBITDA stood at INR 52.5 crore for the quarter and INR 89.4 crore for the half year. Profit Before Tax (PBT), before exceptional items, was INR 18.6 crore in Q2 FY26 and INR 19.5 crore in H1 FY26.

On a consolidated basis, the company reported total revenue of INR 286.4 crore for Q2 FY26 and INR 554.1 crore for H1 FY26. Consolidated Profit After Tax (PAT) stood at INR 164.3 crore compared to INR (14.8) crore in the corresponding quarter last year, while for H1 FY26, PAT stood at INR 163.8 crore compared to INR (48.4) crore in the same period last year.

The company continued to strengthen its operational and financial performance across all business segments during the quarter. The Sugar, Power & Ethanol (SPE) division delivered a steady performance in Q2, a period typically marked by seasonality in the sugar business. Crushing operations for the new season commenced in October 2025, earlier than the previous year, marking the earliest start in the division’s history. Ethanol production and realizations improved on the back of strong blending demand and sustained operational efficiency. The Company also reduced its average borrowing cost by 13 basis points Y-o-Y.

Zuari Infraworld India Ltd (ZIIL), the infrastructure subsidiary, reported an EBITDA of INR 48.1 crore, up 169 per cent Y-o-Y. The St. Regis Residences, Dubai project reached 86 per cent completion, with handovers expected by March 2026. The Development Management mandates in Hyderabad and Kolkata under the asset-light model continue to progress.

The Financial Services businesses continued to record steady growth. Zuari Finserv Ltd (ZFL) reported an EBITDA of INR 1.2 crore and is consistently focusing on expanding its product portfolio, strengthening brand visibility, and reinforcing a customer-first approach. Zuari Insurance Brokers Ltd (ZIBL) achieved an EBITDA of INR 2.9 crore, up 93 per cent Y-o-Y, driven by higher policy renewals and new client acquisitions.

Simon India Ltd (SIL), the EPCM arm, is executing orders worth INR 144 crore and collaborating with research institutions in India and overseas. The company is also in discussions with leading global technology partners for future collaborations and continues to develop in-house AI solutions, reinforcing its focus on becoming a digital- first EPC company.

In the Bioenergy segment, the 180 KLPD bioethanol plant under Zuari Envien Bioenergy Pvt Ltd (ZEBPL) – a 50:50 joint venture between Zuari Industries Limited and Envien International, is scheduled for commissioning in Nov 25.

Commenting on the results, Athar Shahab, Managing Director, Zuari Industries Ltd, said: “The second quarter typically serves as a transition phase for our Sugar, Power & Ethanol division as we prepare for the new crushing season. I am pleased to share that operations commenced in October 2025 – the earliest start in our history. Our operating margins have also improved year-on-year for both the quarter and half year, reflecting our continued focus on operational excellence, cost efficiency and improved sugar price realization. We continued to strengthen financial discipline through lower borrowing rates and reduced finance costs during the year.

“Our real estate business continues to deliver strong performance, with the St. Regis Residences, Dubai project approaching completion. Simon India is steadily building its order pipeline while progressing on its digital transformation journey.

“Our financial services business continues to expand its portfolio through customer-focused initiatives, while the 180 KLPD bioethanol project under our joint venture with Envien is set for commissioning in November 2025.”

News2 days ago

News2 days agoMumbai Returns to Pre-Pandemic Investment Levels, Surpasses $1 Billion 4th Consecutive Year: Cushman & Wakefield

News3 weeks ago

News3 weeks agoUnity Group Launches Unity One Elegante Mall at Netaji Subhash Place, Delhi

News2 days ago

News2 days agoGurugram Premium Segment Drives Projected Rs 6.65 Lakh Crore Market: ANAROCK

News1 day ago

News1 day agoAdani Cement and Coolbrook to Deploy World’s First Commercial Rotodynamic Heater for Cement Decarbonisation

News2 days ago

News2 days agoTIL Ltd Reports Q2 FY26 Results with Enhanced Order Book Position, Strong Execution Momentum

News2 days ago

News2 days agoRobust Demand & New Launches Propel Sri Lotus Developers’ Strong Q2 FY26 Results

News2 weeks ago

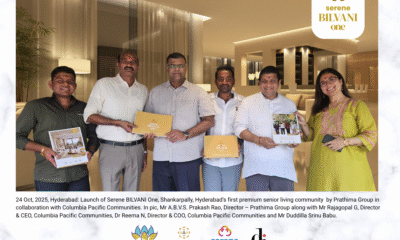

News2 weeks agoSerene Communities Announces ₹400 Crore Investment to Bring Integrated Senior Living to Hyderabad

News2 days ago

News2 days agoUP RERA Approves 6 Real Estate Projects with Investment Worth ₹864 Crore in 5 Districts