Guest Column

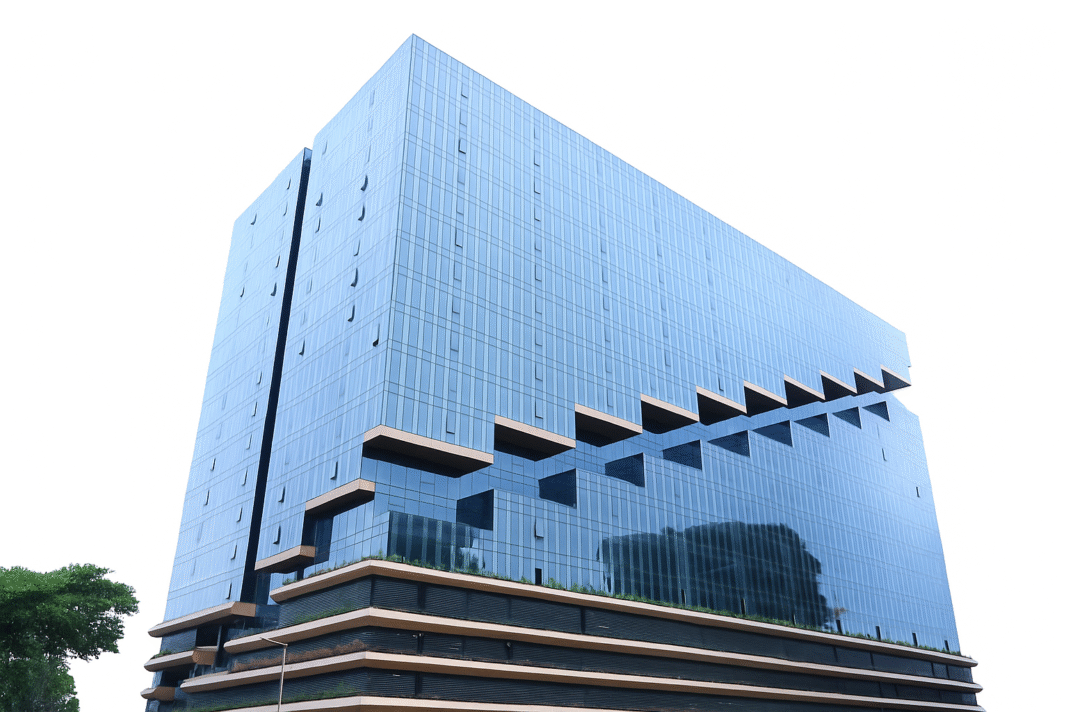

Pre-leased assets commercial assets high on investors’ and occupiers’ radar

- With high rental yields, pre-leased offices come at a premium as compared to residential assets

- Metro properties more in demand despite high rates

- Most visible ticket size of deals – INR 5 to 50 crore

Better returns, a mature and transparent market are some of the factors that have made investors flock to the country’s commercial real estate. With commercial segment remaining the most favoured among all kinds of asset classes, high-net-worth investors and the uber-rich are now looking at pre-leased assets, primarily office assets, with hope.

As a result, the biggest incentive for investors is the rental yield that is much more than that available through traditional investment option – the residential segment. While the yield for Grade A commercial properties ranges from 7.5 to 8.5%, it is 2-3% in the residential segment. And investors start getting returns on their investments immediately and don’t have to scout for a tenant.

A reform-driven professional market

Growth of India’s commercial real estate segment is in a way a barometer to the country’s economic growth. The segment, in particular, has become increasingly lucrative for investors on account of the newly achieved professional standards in recent times. Regulation on Real Estate Investment Trust (REIT), entry of several foreign investors and strict disclosure norms under the real estate regulation (RERA) machinery are some of the indicators of this success.

Country’s regulatory scenario relating to REIT has also come a long way and is now a piece of established machinery for investors. At the beginning of the year, India witnessed its first REIT listing by Blackstone-Embassy JV. The JV between Embassy Office Parks REIT includes Blackstone’s assets as well as those in partnership with Embassy Group, comprising 33 million sq. ft. across Mumbai, Pune, Bengaluru and Noida. 24 million sq. ft of the portfolio is completed and 95% leased. This includes 11 assets—seven office parks and four buildings.

Other than commercial, interest levels are picking up for high street retail and logistics and warehousing industry.

Who & how?

A closer look at the nature of these deals reveals that the range and profile of these investors vary. Increasingly, family offices are focusing on real estate asset segments, especially pre-leased assets. The market continues to witness active demand from HNI’s and CXO’s of corporates etc. However, this is early in the curve, but we anticipate greater participation from Family Offices for real estate investment opportunities.

Most investors look at a deal in the ticket size of Rs 5 to 50 crore. < i>Country’s top six cities including Mumbai, Pune, Bengaluru, NCR, Hyderabad and Chennai followed by tier 2 cities are on their radar.

Despite premium pricing, properties in metros are more in demand than their counterparts in smaller cities. The key reason is that metros have a mature market – hence, it is easy to get tenants and it is easier to liquidate in comparison to that in a smaller, tier 2 market.

What is ahead of us?

It is expected that investors will continue to invest in these segment irrespective of the challenges the segment faces on various fronts. Further clarity is a key aspect that investors demand. The demand is likely to grow in coming years. With the absorption levels at an all-time high and vacancy levels for Grade A assets being in sub-10% zone, properties in most of the micro-markets will continue to witness healthy demand — both from tenants and investors.

The office market is already headed for tremendous growth. The year 2019 is expected to set new benchmarks in terms of new completions, the latter expected to touch 47 mn sq ft levels. Quality supply will continue to draw in occupiers, willing to pre-commit.

-

News4 weeks ago

News4 weeks agoJewar Airport ‘Ready’, Likely to Be Inaugurated by PM Modi By Late Next Month

-

News1 week ago

News1 week agoHiranandani Communities Launches Watersports Centre at Premium Coastal Hiranandani Sands, Alibaug Township

-

News1 week ago

News1 week agoStrategic Partnership between Brigade Group, Primus Senior Living to Develop Senior Living Communities

-

News2 weeks ago

News2 weeks agoSambhav Homes Completes 85-acre Land Delivery for ₹600-Cr ESR Hosur Advanced Manufacturing Park

-

News1 week ago

News1 week agoFY27 Outlook Residential Real Estate: High Base and Affordability Challenges; Tier I Mid-Premium Segment Resilient

-

News4 weeks ago

News4 weeks agoNew Training and Certification System Implemented for Real Estate Agents in Uttar Pradesh

-

Interviews4 weeks ago

Interviews4 weeks agoFrom Square Footage to Soul: Redefining the Urban Living Ecosystem

-

News3 weeks ago

News3 weeks agoEnviro Infra delivers Strong Q3 & 9M FY26 Performance, Nine Month YoY Growth 7.9% in Revenues