Report

Delhi-NCR to witness over 8 mn sq.ft. office leasing in 2022: Savills India Report

February 16, 2022: With a strong vaccination drive and as employees gradually return to office, Delhi-NCR is likely to clock in approximately 8.1 mn sq. ft. in 2022. IT sector is expected to remain among the key occupiers in 2022 as well, according to International real estate advisory firm Savills India.

| Stock | Absorption | Supply | |||

| 2021 | 2022F | 2021 | 2022F | 2021 | 2022F |

| 129.0 mn sq. ft. | 134.1 mn sq. ft. | 7.8 mn sq. ft. | 8.1 mn sq. ft. | 6.6 mn sq. ft. | 5.1 mn sq. ft. |

Outlook for Delhi-NCR office market

- Office leasing is projected to record approximately 8.1 mn sq. ft. in 2022

- IT sector to remain among the key occupiers in 2022. Demand from other sectors such as BFSI and coworking are also likely to show some improvement

- Rentals are expected to witness a steady growth as the market is likely to stabilise from COVID-19 impact, leading to improvement in demand.

- Vacancies could possibly decline to 17-19% in 2022

- Delhi-NCR has a pipeline of around 5.1 mn sq. ft. in 2022. Most upcoming supply is concentrated along Golf Course Extension Road, NOIDA Expressway and NH-8 micro-market and is estimated at approximately 4.6 mn sq. ft.

Key Highlights of 2021 for Delhi-NCR office market

- Gross absorption touched 7.8 mn sq. ft. during the year, a significant increase of 79% YOY, which indicated a strong resurgence in office demand

- IT occupiers accounted for 43% of the total leasing activity in the NCR region in 2021

- Gurugram contributed most to the leasing activity with 63% share, followed by NOIDA with a share of 32%. NOIDA Expressway and Golf Course Extension Road also remained the preferred micro-markets in 2021, with 19% and 15% shares respectively, of the total leasing activity

- Large-size deals of 100,000 sq.ft. or more dominated the leasing activity in NCR, constituting over 41% of the total office space demand in 2021. Micro-markets such as NOIDA Expressway, MG Road and Golf Course Extension Road primarily witnessed large-size transactions

- Mid-size deals (25,000-99,999 sq. ft.) and small-size deals (<25,000 sq. ft.) contributed to 34% and 25% share, respectively

- Delhi also saw a significant rise in new supply by 91% YOY at 500,000 sq. ft.

- The overall vacancy rate increased marginally by 20 basis points YOY and settled at 21.6% in 2021 from 21.4% in 2020

- On a YOY basis, average office rentals in NCR decreased by 4%. NOIDA saw the highest decline in rentals by 6% YOY, whereas Delhi and Gurugram rentals declined by 5% and 3% respectively

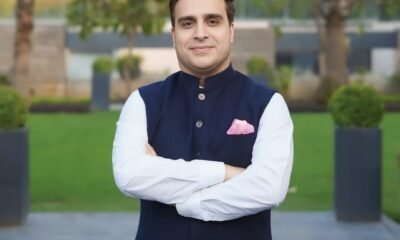

Shweta Sawhney, MD, Delhi-NCR, Savills India said,” The leasing momentum picked up significantly after the second wave in H2 2021. The mass vaccination drive and unlocking of the economy has aided the revival of the office market in NCR. Large-size deals of 100,000 sq.ft. or more dominated the leasing activity in NCR, constituting over 41% of the total office space demand in 2021. Micro-markets such as NOIDA Expressway, MG Road and Golf Course Extension Road primarily witnessed large-size transactions. Also, due to marginal correction in rentals, Gurugram contributed most to the leasing activity with 63% share, followed by NOIDA with a share of 32%. These micro markets are continuing to see a very healthy demand both driven by expansions and relocations and hence 2022 is likely to be the year of revival for the NCR office market.”

-

News3 weeks ago

News3 weeks agoMumbai’s Largest Trimandir Opens in Thane with Grand Three-Day Pran-Pratistha Ceremony

-

News3 weeks ago

News3 weeks agoBudget 2026: Real Estate Sector Awaits Real Reform, Targeted Relaxations For Boost

-

News3 weeks ago

News3 weeks agoUnion Budget 2026: Infrastructure-Led Growth Sets Stage for Real Estate Expansion Beyond Metros

-

News4 weeks ago

News4 weeks agoHousing.com Expands Footprint to 15 Tier II Cities, Strengthening Presence in Emerging Residential Markets

-

News3 weeks ago

News3 weeks agoNCDRC Directs District Magistrate to Take Over Control of Much Delayed Greater Noida Project

-

News4 weeks ago

News4 weeks agoLuxury Housing in 2026: Experience, Exclusivity & Design-Led Living

-

News2 weeks ago

News2 weeks agoJewar Airport ‘Ready’, Likely to Be Inaugurated by PM Modi By Late Next Month

-

News3 weeks ago

News3 weeks agoBudget 2026 Positions Tourism & Hospitality as Economic Multiplier, Not Support Sector