News

Bank of Baroda Strengthens Presence in Housing Sector with Delhi-NCR Property Expo 2025

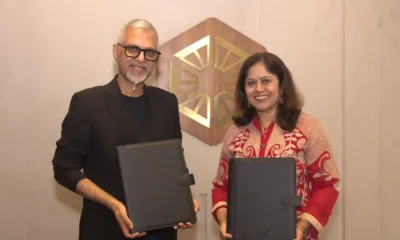

Sanjay Mudaliar, Executive Director, Bank of Baroda

New Delhi, November 24, 2025: Bank of Baroda hosted the ‘Bank of Baroda Property Expo 2025 – Delhi Edition’, on November 22 and 23, 2025 at Yashobhoomi (IICC), Dwarka, New Delhi. Specially curated and led by the Bank, the Expo underscored Bank’s commitment to support homebuyers not just as a lender, but as a holistic partner in their home-buying journey.

The two-day event brought together around 20 leading developers showcasing a wide range of high-quality, approved residential projects across Delhi, Gurgaon, Noida, Greater Noida, Ghaziabad, and Faridabad. Day 1 of the Expo saw strong footfalls with homebuyers exploring options across affordable, mid-income, premium, and luxury segments, including OC-ready, under-construction, and redevelopment properties.

A crucial part of the home buying journey is access to the right financing and Bank of Baroda supported visitors with personalised loan consultations, on-the-spot in-principle approvals and special concessional interest rates for women borrowers.

The Bank offered a 0.25% concession in Rate of Interest on all on-the-spot home loan sanctions and waiver of processing fees for all approvals given during the Expo.

Speaking at the Property Expo, Sanjay Mudaliar, Executive Director, Bank of Baroda said, “ The Delhi-NCR region continues to be among the most dynamic housing markets in India, with strong demand from both salaried and self-employed segments. As a leading and trusted housing finance provider, the Bank of Baroda Property Expo 2025 serves as a platform that brings together the region’s leading developers, verified projects, and bank-led financial support all in one place — creating a seamless experience for customers. The response to the Expo has been very encouraging. We remain committed to making the home-buying experience convenient, transparent, and accessible for all.”

The Expo further reinforced Bank of Baroda’s strong momentum in retail assets, with home loans being a key growth driver. It reported a 17.6 per cent year-on-year increase in retail advances in the quarter ended September 30, 2025, supported by robust, sustained demand in home loans and mortgages. With home loan interest rates starting at 7.45 per cent p.a., the Bank continues to be a preferred choice for home buyers seeking competitive and customer-centric financing solutions.

News2 weeks ago

News2 weeks agoDN Group Sets National Expansion and IPO Roadmap at DN DAY 2025

News4 weeks ago

News4 weeks agoGulshan Group Partners with Taj to Redefine Branded Living in Noida

News2 weeks ago

News2 weeks agoBPTP Appoints Vineet Nanda as Chief Business Officer

News3 weeks ago

News3 weeks agoDelhi–NCR Malls Roll Out Festive Christmas Celebrations with Lights, Events & Family Activities

News6 days ago

News6 days agoIndian Real Estate in 2025: From Roller-Coaster Rides to Rock-Solid Foundations

News2 weeks ago

News2 weeks agoEmbassy REIT Closes ₹530 Cr Selloff at Embassy Manyata in Bengaluru to EAAA Alternatives’ Real Assets Business

News4 days ago

News4 days agoDanube Group’s Rizwan Sajan to Host Bigg Boss 19 Contestants in Dubai on January 6–7

News2 weeks ago

News2 weeks ago2025 Set the Base: What India’s Real Estate Momentum Signals for 2026