News

India’s Silver Economy: A $50-billion Market Opportunity by 2030

New Delhi, August 27, 2025: India’s population aged 60 and above currently exceeds 150 million and this figure is expected to more than double to 347 million by 2050. This demographic shows greater technological proficiency, consumerism, financial security and aspirations beyond basic needs. Their expectations include a wellness-oriented lifestyle, active and engaging avenues, new experiences, spiritual support and comprehensive financial and succession planning.

The growth in retirement-focused mutual funds, demonstrated by a 226 per cent increase over five years, from INR 9,800 crore in June 2020 to INR 31,973 crore in June 2025 (RTR, Bajaj Capital Estimates), indicates considerable financial affordability.

The private sector NPS AUM also shows a similar trend with a 26.8 per cent increase over the past five years, climbing from INR 84,814 crore to INR 2,78,102 crore, and is expected to exceed INR 9.12 lakh crore in AUM with 15 million subscribers in the next five years (The Economic Times estimates).

Attractive Business Opportunity

The senior care industry is poised for continued evolution and diversification with the sector projected to reach approximately $50 billion by 2030, growing at a compound annual rate of 20 per cent (PwC-ASLI).

The senior living industry alone is estimated to be $8 billion by 2030 (JLL-ASLI report). A recent survey by ASLI and PwC shows that 85-90 per cent of industry leaders are highly optimistic about the sector’s growth in India over the next 15 years with most planning active investment, diversification and service expansion.

“With the sector projected to grow 20 per cent annually to nearly $50 billion by 2030, India must pair scale with compassion. We believe that with innovation, collaboration and supportive regulation, senior care in India can set new benchmarks,” said Ankur Gupta, Co-Founder, ASLI, and Joint MD, Ashiana Housing.

Investment Hotbed

The sector is witnessing robust investment with nearly 20 deals in the last 18 months alone. Investment ticket sizes have crossed INR 100 crore, new investors have signed up and the target portfolio has diversified.

Supply Ramp Up

In response to growing demand, supply is anticipated to increase substantially. The current organised supply infrastructure serves approximately 3-4 million seniors with projections indicating that capacity will more than triple in the next five years.

The senior living capacity is likely to increase 5x by 2030 (JLL -ASLI report). Premium senior living facilities are experiencing strong performance with occupancy rates consistently maintaining 80-85 per cent. Nevertheless, the projected increase in supply is expected to remain insufficient to meet potential demand.

“India’s senior living sector is at a critical inflection point with the target market expanding to 2.3 million households by 2030 and market penetration nearly doubling to 2.5 per cent,” said Karan Singh Sodi, Senior MD, Mumbai MMR and Gujarat, and Head, Alternatives, India, JLL.

“India operates at just 1.4 per cent market penetration versus 6 per cent-plus in mature markets. This supply-demand gap presents a golden opportunity for strategic investors in one of India’s most vibrant emerging sectors. The sector’s transformation will be driven by innovative solutions and operational model changes with Maharashtra’s Housing Policy 2025 serving as a progressive blueprint that could unlock national-scale investment.”

Steady Evolution

As the senior population grows, both domestic and international investors are fuelling innovation and expanding service options. The sector will likely integrate best practices and innovations from real estate, BFSI and healthcare industries.

Expect more diverse providers, facilities in various locations and innovative service and payment models. The portfolio of services is likely to further diversify to include more skilled nursing care centres, specialised geriatric centres, continuing care retirement communities and other specialised care service providers.

Enabling Regulatory Regimen

A streamlined, progressive regulatory framework is crucial for the growth of senior care in India. This should include single-window clearances, clarity in registration and incentives for global best practices in safety and service quality.

Updated financial regulations, such as providing financial independence to the senior population through reverse mortgage loans and enabling long-term loans by classifying senior living projects as ‘infrastructure status’, can facilitate growth. Setting minimum standards for infrastructure, staffing and healthcare integration will ensure quality care nationwide.

Similarly, rationalising GST considerations to five per cent or lower on senior care services, along with having more innovation in health insurance and retirement planning solutions for seniors, can help improve affordability further.

What Leaders Say

Rajit Mehta, Chairman, ASLI and MD and CEO, Antara Senior Care, said, “India’s Silver Generation has more money than the previous one, and they’re investing it in their golden years. While as many as 70 per cent of seniors remain financially dependent even today, this trend is changing.”

The right financial and insurance innovation can help unlock the economic opportunity presented by India’s demographic evolution. “But investing in India’s senior care sector is more than a financial opportunity. It is a commitment to shaping a future where longevity meets dignity, innovation and community. Those who invest now in the senior care sector will enable better lives and also unlock resilient, long-term value in a rapidly expanding market.”

Rana Mehta, PwC India Partner and Leader, Health advisory, said, “A thriving senior care sector is not only vital for ensuring dignity and well-being for India’s aeging population but also represents one of the nation’s most promising, resilient business opportunities for forward-thinking investors and innovators.”

As the focus shifts from simply extending lifespan to actively enhancing health span, “we must reimagine aeging not as decline but as possibility. By investing in preventive care, active lifestyles and age-inclusive innovation, India has the chance to move from a ‘silver economy’ narrative of dependency to an evergreen economy—one where longevity fuels growth, productivity, and intergenerational value creation”.

Call to Action: Mumbai, Sept 17

The Association of Senior Living India (ASLI) will host its flagship conclave on September 17 in Mumbai with PwC India as knowledge partner & JLL India as research partner, bringing together investors, providers and regulators to discuss developments in the sector. The event offers an opportunity for attendees to learn about senior care, exchange ideas and engage in discussions related to growth within the industry.

News3 weeks ago

News3 weeks agoUnity Group Launches Unity One Elegante Mall at Netaji Subhash Place, Delhi

News2 days ago

News2 days agoMumbai Returns to Pre-Pandemic Investment Levels, Surpasses $1 Billion 4th Consecutive Year: Cushman & Wakefield

News2 days ago

News2 days agoGurugram Premium Segment Drives Projected Rs 6.65 Lakh Crore Market: ANAROCK

News1 day ago

News1 day agoAdani Cement and Coolbrook to Deploy World’s First Commercial Rotodynamic Heater for Cement Decarbonisation

News2 days ago

News2 days agoTIL Ltd Reports Q2 FY26 Results with Enhanced Order Book Position, Strong Execution Momentum

News1 day ago

News1 day agoRobust Demand & New Launches Propel Sri Lotus Developers’ Strong Q2 FY26 Results

News2 weeks ago

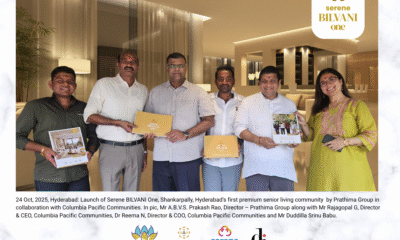

News2 weeks agoSerene Communities Announces ₹400 Crore Investment to Bring Integrated Senior Living to Hyderabad

News2 days ago

News2 days agoUP RERA Approves 6 Real Estate Projects with Investment Worth ₹864 Crore in 5 Districts