News

Kalpataru Reports Robust Q1 FY26 Pre-Sales Growth Of 83% YOY

Mumbai, August 13, 2025: Kalpataru Limited reported an 83 per cent YoY rise in pre-sales value at INR 1,249 crore in Q1 FY26 against INR 682 crore in Q1 FY25.

Collections stood at INR 1,147 crore against INR 838 crore in Q1 FY25, up 37 per cent YoY. Area sold was 0.56 msf against 0.61 msf sold in Q1 FY25, down by nine per cent YoY, while average sale realisation was INR 22,476 per sq ft as against INR 11,199 per sq ft in the same period last year, up 101 per cent YoY.

Revenues from operations stood at INR 443 crore. Adjusted EBITDA stood at INR 104 crore and adjusted EBITDA margin was 23.4 per cent. PAT was INR 52 crore.

“We are pleased to share the performance highlights of Kalpataru Limited for the quarter ended June 2025—a period marked by strong operational performance and balance sheet strengthening. This also happens to be the last quarter for which the company is reporting its performance before getting listed on July 1, 2025,” said Parag Munot, MD, Kalpataru Limited.

“The company has utilised INR 1,192.5 crore from IPO proceeds towards debt repayment, in line with the objects of the issue and remains committed to further strengthening the balance sheet through continued debt reduction efforts.”

He added, “We have a strong launch pipeline for FY26 with a saleable area of 3.16 msf spread across Mumbai and Thane. Looking ahead, we remain committed to deepening our presence in key micro-markets across MMR and Pune, anchored by the trust we’ve built. Our focus will continue to be on timely project execution to drive collections and strengthen cash flows as well as driving strong pre-sales across our projects.”

Net Debt as on June 30 stood at INR 7,939 crore and net debt/equity ratio was 2.0x as compared to 3.8x as on March 31.

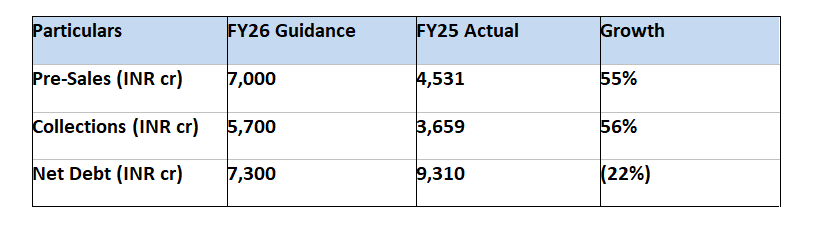

FY26 Guidance

-

News3 weeks ago

News3 weeks agoMumbai’s Largest Trimandir Opens in Thane with Grand Three-Day Pran-Pratistha Ceremony

-

News3 weeks ago

News3 weeks agoBudget 2026: Real Estate Sector Awaits Real Reform, Targeted Relaxations For Boost

-

News3 weeks ago

News3 weeks agoUnion Budget 2026: Infrastructure-Led Growth Sets Stage for Real Estate Expansion Beyond Metros

-

News4 weeks ago

News4 weeks agoHousing.com Expands Footprint to 15 Tier II Cities, Strengthening Presence in Emerging Residential Markets

-

News3 weeks ago

News3 weeks agoNCDRC Directs District Magistrate to Take Over Control of Much Delayed Greater Noida Project

-

News4 weeks ago

News4 weeks agoLuxury Housing in 2026: Experience, Exclusivity & Design-Led Living

-

News2 weeks ago

News2 weeks agoJewar Airport ‘Ready’, Likely to Be Inaugurated by PM Modi By Late Next Month

-

News3 weeks ago

News3 weeks agoBudget 2026 Positions Tourism & Hospitality as Economic Multiplier, Not Support Sector