News

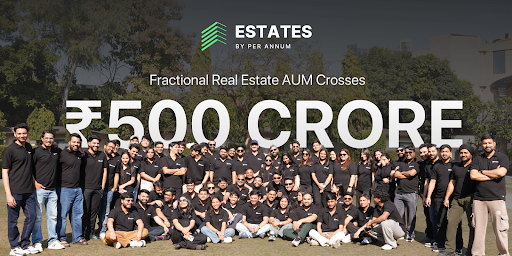

Per Annum’s Fractional Real Estate Platform ‘Estates’ Crosses ₹500 Crore AUM in Under a Year

New Delhi, February 12, 2026: Per Annum, an alternative investment platform with over a decade of operating history, announced that its fractional real estate vertical, ‘Estates’, has surpassed INR 500 crore in Assets Under Management (AUM) within its first year of launch, marking a significant milestone in the company’s growth journey.

The milestone coincides with Per Annum completing a decade of operations, underscoring its evolution from a fintech startup into a full-fledged alternative investment platform catering to modern Indian investors.

Launched in March 2025, Estates demonstrated rapid product-market fit, reaching INR 100 crore in AUM within just 30 days of launch. The momentum continued through the year, with assets doubling to INR 250 crore by September 2025 before accelerating to cross the INR 500 crore mark in December 2025.

Unlike conventional fractional ownership platforms focused on commercial assets and rental yields, Estates concentrates on luxury residential real estate, offering investors exposure to under-construction projects and the capital appreciation potential of the development lifecycle.

“This milestone is particularly meaningful as it coincides with Per Annum completing ten years of operations. Estates’ rapid scale from INR 100 crore in the first 30 days to INR 500 crore within a year underscores how disciplined execution, developer partnerships, and a clear focus on capital appreciation can unlock new possibilities in the space,” said Ekmmeet Singh, CEO and Co-founder of Per Annum.

Over the past nine months, the platform facilitated the acquisition of 120 luxury residential units. To mitigate delivery and execution risks commonly associated with under-construction projects, Per Annum has restricted its portfolio exclusively to Tier-1 developers, including L&T, Godrej, and Mahindra.

While Estates initially established a strong presence in Gurgaon, the latter half of the year saw strategic geographic diversification. The portfolio now spans Noida, Mumbai, and Bangalore, aligning with renewed residential demand across India’s major IT and commercial corridors.

Per Annum’s ability to scale Estates to INR 500 crore in AUM in under a year signals the growing maturity of India’s fractional real estate ecosystem. Backed by ten years of operational credibility, the platform is enabling retail investors to access premium residential assets positioning fractional ownership as a viable investment avenue at a time when direct real estate ownership is increasingly out of reach.

-

News4 weeks ago

News4 weeks agoJewar Airport ‘Ready’, Likely to Be Inaugurated by PM Modi By Late Next Month

-

News4 weeks ago

News4 weeks agoBudget 2026 Positions Tourism & Hospitality as Economic Multiplier, Not Support Sector

-

News1 week ago

News1 week agoHiranandani Communities Launches Watersports Centre at Premium Coastal Hiranandani Sands, Alibaug Township

-

News6 days ago

News6 days agoStrategic Partnership between Brigade Group, Primus Senior Living to Develop Senior Living Communities

-

News4 weeks ago

News4 weeks agoAshiana Care Homes & Epoch Elder Care Partner to Strengthen Assisted Living & Specialized Senior Care in India

-

News2 weeks ago

News2 weeks agoSambhav Homes Completes 85-acre Land Delivery for ₹600-Cr ESR Hosur Advanced Manufacturing Park

-

Interviews3 weeks ago

Interviews3 weeks agoFrom Square Footage to Soul: Redefining the Urban Living Ecosystem

-

News4 weeks ago

News4 weeks agoNew Training and Certification System Implemented for Real Estate Agents in Uttar Pradesh