News

SAMHI Reports 356% Jump in PAT, EBITDA Margin Expands to 37%

Gurugram, August 14, 2025: SAMHI Hotels Limited, a prominent branded hotel ownership and asset management platform in India, reported a 353.8 per cent jump in PAT YoY to INR 192 million in Q1 of FY26.

Total income for the quarter was INR 2,873 million, up 13 per cent YoY. EBITDA for the quarter was INR 1,056 million, up 18.6 per cent YoY.

Revenue per available room was INR 4,760, up 10.3 per cent on a YoY. Business performance in May was temporarily affected due to geopolitical events, leading to a short-term deviation. From June, YoY performance metrics reverted to April level, indicating a return to normal operating conditions. Occupancy stood at 74 per cent for Q1FY26.

“We are pleased to announce results for the period ending June 30. Despite a short interruption due to geopolitical issues, we continue to see good growth across our portfolio. This sets a strong base for the future,” said Ashish Jakhanwala, CMD, SAMHI Hotels Ltd.

“Total revenue growth was 13.0 per cent with a consol. EBITDA growth of 18.6 per cent over the same period last year despite a moderate growth during May. With strong growth in EBITDA and a reduction in the finance cost, we witnessed 4.5x growth in PAT for the quarter.”

Post the recently concluded transaction with GIC, “we have strengthened our balance sheet to allow us to focus on growth. With a strong pipeline of assets under rebranding and/or completion, we are excited about the overall prospects of our company. We also estimate a strong investible surplus available that will allow us to seek value-accretive M&A and continued expansion through highly capital-efficient variable leases”.

“We have also agreed to sell Caspia Hotel, New Delhi. This follows our stated strategy of capital recycling to improve returns for shareholders. Since 2023, we have concluded over INR 2.1 billion of asset sales at an average EV/EBITDA multiple of 20x and incremental INR 7.5 billion of minority dilution in favour of GIC. At the same time, we have invested/committed to invest INR 10.0 million-plus in new assets and rebranding, which will be at a material premium in terms of returns.”

Consolidated Financial Highlights:

1. Based on the same store, i.e., excludes the Four Points by Sheraton, Chennai OMR sold in Feb’25, Trinity acquired in Oct’24, HIEX Greater Noida (reopened in Dec’24), HIEX Kolkata (opened in May’25), Caspia Delhi (discontinued operation) and Sheraton Commercial.

2. Q1FY26 PAT attributable to SAMHI is Rs 173 mn, and minority interest is Rs 19 mn

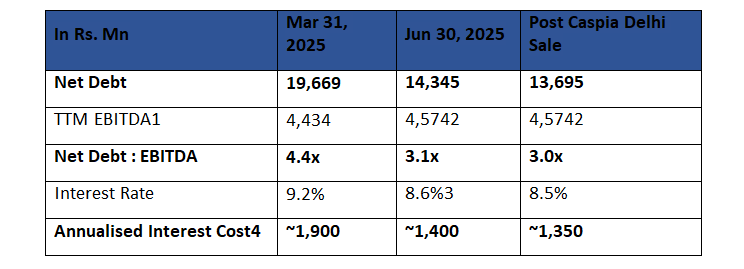

Debt Profile:

-

News3 weeks ago

News3 weeks agoMumbai’s Largest Trimandir Opens in Thane with Grand Three-Day Pran-Pratistha Ceremony

-

News3 weeks ago

News3 weeks agoBudget 2026: Real Estate Sector Awaits Real Reform, Targeted Relaxations For Boost

-

News3 weeks ago

News3 weeks agoUnion Budget 2026: Infrastructure-Led Growth Sets Stage for Real Estate Expansion Beyond Metros

-

News4 weeks ago

News4 weeks agoHousing.com Expands Footprint to 15 Tier II Cities, Strengthening Presence in Emerging Residential Markets

-

News3 weeks ago

News3 weeks agoNCDRC Directs District Magistrate to Take Over Control of Much Delayed Greater Noida Project

-

News4 weeks ago

News4 weeks agoLuxury Housing in 2026: Experience, Exclusivity & Design-Led Living

-

News2 weeks ago

News2 weeks agoJewar Airport ‘Ready’, Likely to Be Inaugurated by PM Modi By Late Next Month

-

News3 weeks ago

News3 weeks agoBudget 2026 Positions Tourism & Hospitality as Economic Multiplier, Not Support Sector