News

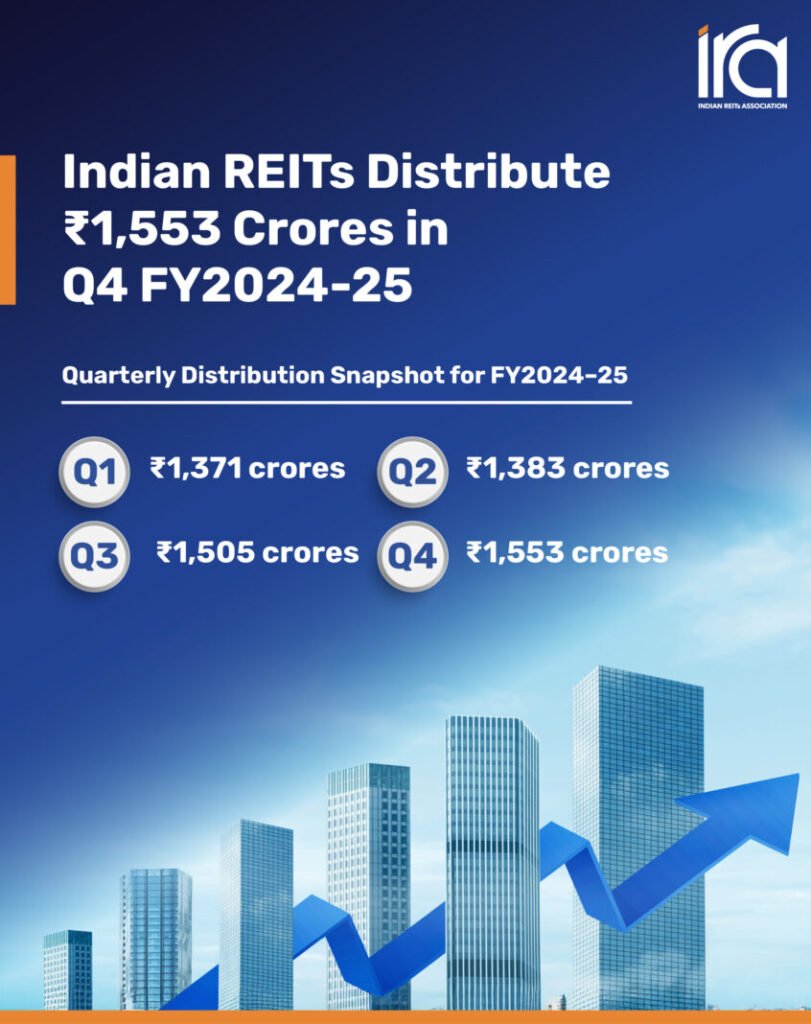

4 Indian REITs Distribute ₹1,553 Crore in Q4 FY2024-25

New Delhi, May 15, 2025: India’s four publicly listed Real Estate Investment Trusts (REITs) have collectively distributed over INR 1,553 crore to more than 2.64 lakh unitholders during the fourth quarter of the financial year ended March 31. This marks around 13 per cent increase compared to INR 1,377 crores distributed in the same quarter of the financial year ended March 31, 2024.

For the full financial year 2024–25, the cumulative distribution by the four REITs reached INR 6,070 crore, up from INR 5,366 crore in FY 2023–24, reflecting a strong and consistent over 13 per cent YoY growth.

The four listed REITs in India—Brookfield India Real Estate Trust, Embassy Office Parks REIT, Mindspace Business Parks REIT and Nexus Select Trust—continue to demonstrate resilience and long-term value creation.

The four REITs reported a net operating income (NOI) of INR 89,100 crore in FY2025 compared to INR 76,626 crore in FY2024—an increase of INR 12,474 crore, representing 16 per cent YoY growth. Their total revenue from operations also rose by 16 per cent from INR 97,482 crore in FY2024 to INR 1,12,802 crore in FY2025—an increase of INR 15,320 crore.

“The robust quarterly distributions and expanding investor base reflect the increasing maturity and investor confidence in India’s REIT ecosystem,” Alok Aggarwal, MD and CEO, Brookfield India Real Estate Trust, and Chairman of the Indian REITs Association, said.

“A 13 per cent YoY increase in distributions underscores the strength and stability of the sector, driven by high-quality assets and strong leasing activity, particularly from Global Capability Centres and strong domestic demand. We remain optimistic about the long-term prospects of Indian REITs amid evolving market dynamics.”

India’s REIT market manages gross assets under management exceeding INR 1.63 lakh crore with a combined market capitalisation of over INR 98,000 crore (as of 14 May).

The four REITs collectively operate more than 128.9 million square feet of Grade A office and retail real estate across key urban centres.

Since their respective inceptions, these four REITs have distributed a cumulative total of over INR 22,800 crore to unitholders, highlighting their rising prominence among both institutional and retail investors.

The Indian REITs Association, a non-profit industry body established with the support of the Securities and Exchange Board of India and the Ministry of Finance, comprises the four listed REITs as founding members. The association continues to play a pivotal role in representing the interests of the sector and promoting transparency, best practices and long-term growth.

News2 weeks ago

News2 weeks agoDN Group Sets National Expansion and IPO Roadmap at DN DAY 2025

News4 weeks ago

News4 weeks agoGulshan Group Partners with Taj to Redefine Branded Living in Noida

News3 weeks ago

News3 weeks agoBPTP Appoints Vineet Nanda as Chief Business Officer

News3 weeks ago

News3 weeks agoDelhi–NCR Malls Roll Out Festive Christmas Celebrations with Lights, Events & Family Activities

News6 days ago

News6 days agoIndian Real Estate in 2025: From Roller-Coaster Rides to Rock-Solid Foundations

News2 weeks ago

News2 weeks agoEmbassy REIT Closes ₹530 Cr Selloff at Embassy Manyata in Bengaluru to EAAA Alternatives’ Real Assets Business

News4 days ago

News4 days agoDanube Group’s Rizwan Sajan to Host Bigg Boss 19 Contestants in Dubai on January 6–7

News2 weeks ago

News2 weeks ago2025 Set the Base: What India’s Real Estate Momentum Signals for 2026