News

Repo rate unchanged eighth time in a row

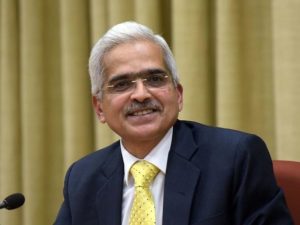

The Reserve Bank of India‘s monetary policy committee (MPC) on October 8 kept the key lending rate (repo rate) unchanged at 4 per cent for the eighth time in a row. The reverse repo rate was kept unchanged at 3.5 per cent.

The MPC voted 5-1 to retain the accommodative stance as long as necessary to sustain growth on a durable basis, while ensuring that inflation remains within the target, RBI Governor Shaktikanta Das said while announcing the decision.

The MPC voted 5-1 to retain the accommodative stance as long as necessary to sustain growth on a durable basis, while ensuring that inflation remains within the target, RBI Governor Shaktikanta Das said while announcing the decision.

The central bank retained the FY22 GDP growth forecast at 9.5 per cent. CPI inflation for the current fiscal was projected at 5.3 per cent.

The RBI announcement comes against the backdrop of COVID-19 infections receding in recent days and the economy stablising.

-

News2 weeks ago

News2 weeks agoMumbai’s Largest Trimandir Opens in Thane with Grand Three-Day Pran-Pratistha Ceremony

-

News2 weeks ago

News2 weeks agoBudget 2026: Real Estate Sector Awaits Real Reform, Targeted Relaxations For Boost

-

News3 weeks ago

News3 weeks agoVianaar Homes Earns Great Place to Work® Certification in India

-

News4 weeks ago

News4 weeks agoBOOTES Enters Residential Development with ₹6,300-Cr Inventory, Redefining Luxury Through Clean-Air Living

-

News1 week ago

News1 week agoUnion Budget 2026: Infrastructure-Led Growth Sets Stage for Real Estate Expansion Beyond Metros

-

News3 weeks ago

News3 weeks agoCommercial Leasing Trends Evolve to Keep Pace with Development in Noida, Greater Noida

-

News3 weeks ago

News3 weeks agoRASA Group Introduces AVANI Infratech, Focused on Residential, Commercial and Industrial Land Assets

-

News4 weeks ago

News4 weeks agoRealty & More Now Works Out of Ofis Square, The Iconic Corenthum, Noida