News

Home Loan Volume, Value See Double-Digit Growth; High-Ticket Loans Reach 21% Share: Urban Money

Mumbai, June 3, 2025: Residential property registration across key cities has continued to rise steadily in recent years. Data from Urban Money (FinTech venture by Square Yards) shows that the total number of registered residential transactions in key cities*, as recorded by the Inspector General of Registration (IGR), increased from 3.07 lakh units in FY 2019 to 5.44 lakh units in FY 2025—a 77 per cent growth over the six years.

This upward trend is also reflected in the housing finance sector, which plays a critical role in supporting residential real estate. According to Urban Money’s latest report, Housing Finance – The Quiet Catalyst Driving India’s Property Market, the volume and value of home loans in major cities have increased by 10 per cent and 15 per cent, respectively.

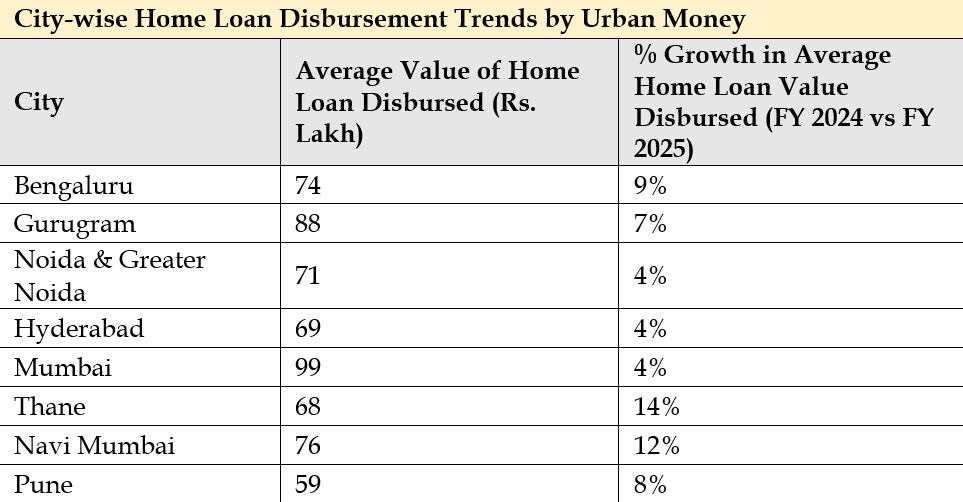

The report covers cities including Bengaluru, Gurugram, Noida, Greater Noida, Hyderabad, Mumbai, Thane, Navi Mumbai and Pune.

“At Urban Money, we started with a simple goal—make housing finance in India easier, faster, and more accessible. The market was largely fragmented, with long paperwork and delayed sanctions,” said Amit Prakash Singh, CBO, Urban Money, and cofounder, Square Yards.

“So, we built a digital-first platform, forged strong partnerships with lenders and scaled a robust on-ground network of 500-plus offices and 50,000-plus agents—enabling us to become India’s largest organised distributor of secured mortgages.”

He added, “What’s even more encouraging is how the broader market is evolving. As highlighted in our latest report, home loan volumes in top cities grew by 10 per cent YoY, and the total value disbursed rose 15 per cent YoY in FY25. Home loans above INR 1 crore now make up 21 per cent of disbursals, reflecting rising demand for premium housing.”

With one in every five home loans going to a woman borrower, “we’re witnessing a shift towards more empowered and inclusive homeownership. All these shifts highlight rising urban aspirations, stable credit conditions and evolving homeownership trends across the country”.

Urban Money’s latest trends and insights for FY 2025 highlight key shifts in the home loan segment across major residential real estate markets:

- Property-linked loans, comprising home loans and loans against property, accounted for the largest share—63 per cent—of total loan disbursals in FY 2025

- During the same period, the number of home loans disbursed in the top cities grew by 10 per cent YoY. This included a 10 per cent increase among male borrowers and a 9 per cent increase among female borrowers

- In FY 2025, the total value of home loans disbursed in these cities rose by 15 per cent, reflecting a shift towards premium homes and a notable increase in property prices—up by approximately 55–60 per cent on average since FY 2019. Year-on-year growth in disbursal value stood at 14 per cent for men and 23 per cent for women

- Home loans above the INR 1 crore ticket size accounted for 21 per cent of total disbursals in FY 2025. In comparison, home loans below INR 45 lakh accounted for 47 per cent of disbursals while those between INR 45 lakh and INR 1 crore made up 32 per cent

- One in five home loans disbursed during FY 2025 was to a woman borrower, reflecting a rising participation of women in property ownership

- The average home loan value in the top cities reached INR 74 lakh in FY 2025, marking a five per cent YoY increase. For male borrowers, the average stood at INR 76 lakh (three-plus per cent YoY) while for women it was INR 70 lakh—growing at the fastest rate of 13 per cent YoY

- Mumbai and Gurugram recorded the highest average home loan values at INR 99 lakh and INR 88 lakh, respectively, in FY 2025

*Analysis includes key residential markets: Bengaluru, Noida, Greater Noida, Gurugram, Hyderabad, Mumbai, Navi Mumbai, Thane and Pune.

Source: Urban Money

Fintech and Urbanisation Driving Momentum in Housing Finance

The growth in residential real estate and housing finance is driven by strong end-user demand, continued urbanisation, progressive government initiatives and rapid advances in digital infrastructure. The rise of fintech platforms has played a key role by improving credit assessment processes, expanding access to credit and enhancing the overall borrowing experience.

Urban Money, a FinTech venture by Square Yards, is at the forefront of this transformation. As one of the largest mortgage distribution networks in India, Urban Money operates as a leading digital lending marketplace and fintech platform. It aggregates loan offerings from banks and NBFCs, delivering a seamless, end-to-end experience—from product selection to documentation, tax and insurance guidance and disbursal support.

-

News4 weeks ago

News4 weeks agoMumbai’s Largest Trimandir Opens in Thane with Grand Three-Day Pran-Pratistha Ceremony

-

News4 weeks ago

News4 weeks agoBudget 2026: Real Estate Sector Awaits Real Reform, Targeted Relaxations For Boost

-

News4 weeks ago

News4 weeks agoUnion Budget 2026: Infrastructure-Led Growth Sets Stage for Real Estate Expansion Beyond Metros

-

News4 weeks ago

News4 weeks agoNCDRC Directs District Magistrate to Take Over Control of Much Delayed Greater Noida Project

-

News3 weeks ago

News3 weeks agoJewar Airport ‘Ready’, Likely to Be Inaugurated by PM Modi By Late Next Month

-

News4 weeks ago

News4 weeks agoBudget 2026 Positions Tourism & Hospitality as Economic Multiplier, Not Support Sector

-

News4 weeks ago

News4 weeks agoAIPL Acquires 43-Acre Gurugram Land for ₹1,000 Cr Through DRT

-

News4 weeks ago

News4 weeks agoAshiana Care Homes & Epoch Elder Care Partner to Strengthen Assisted Living & Specialized Senior Care in India