News

NCW Prime Offices Fund Buys Out Chennai Office Campus from Keppel

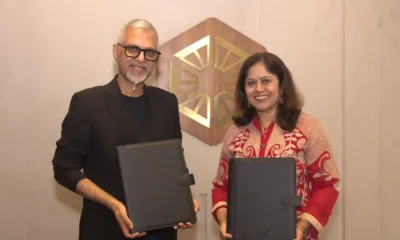

Chennai, September 25, 2025: Prime Offices Fund (PRIME), a Commercial Real Estate focussed fund managed by Nuvama and Cushman & Wakefield Management Private Limited (NCW), a joint venture between Nuvama Asset Management Limited and Cushman and Wakefield, has announced the acquisition of a marquee 2.4 million square feet office campus located in Porur, Chennai. The asset was acquired through a 100 per cent buyout from Keppel’s real estate division, at transaction value of approximately INR 2,550 crore, marking PRIME’s second acquisition and a significant milestone in its strategy to build a portfolio of future ready, high-quality, ESG-compliant office assets across India’s fastest-growing micro-markets.

The Campus is a LEED Platinum development, leased to a diversified tenant base comprising both Global Capability Centres (GCC) and domestic technology majors. Located in one of Chennai’s most attractive office corridors, the asset offers institutional-grade infrastructure, campus style amenities and excellent connectivity to key residential and commercial hubs.

This acquisition underscores PRIME’s philosophy of investing in future-ready, sustainable, performance-led assets in strategic micro-markets that cater to the evolving needs of global occupiers. With its scale, sustainability credentials, and blue-chip tenant profile, the asset strengthens the fund’s ability to deliver resilient returns and long-term value to investors.

This landmark transaction is one of the largest ever in the rapidly expanding Indian Office market. This also marks the largest trade executed by any domestic fund, in a space otherwise dominated by global capital pools. This milestone reinforces PRIME’s commitment to delivering global standard investments tailored for domestic investors.

Gaurav Puri, Chief Investment Officer, NCW commented, “This second acquisition under PRIME is a strong validation of our strategy and execution. With this, we’re reinforcing our commitment to building a portfolio that reflects the evolving priorities of global occupiers: sustainability, agility, and institutional-grade quality. Chennai continues to attract deep occupier interest, especially from GCCs, and Porur stands out as a micro-market with long-term fundamentals. As we expand our footprint, our focus remains on high quality ‘offices-of-the-future’ that meet the expectations of our investors and set new benchmarks for commercial real estate in India.”

News2 weeks ago

News2 weeks agoDN Group Sets National Expansion and IPO Roadmap at DN DAY 2025

News4 weeks ago

News4 weeks agoGulshan Group Partners with Taj to Redefine Branded Living in Noida

News3 weeks ago

News3 weeks agoBPTP Appoints Vineet Nanda as Chief Business Officer

News3 weeks ago

News3 weeks agoDelhi–NCR Malls Roll Out Festive Christmas Celebrations with Lights, Events & Family Activities

News6 days ago

News6 days agoIndian Real Estate in 2025: From Roller-Coaster Rides to Rock-Solid Foundations

News2 weeks ago

News2 weeks agoEmbassy REIT Closes ₹530 Cr Selloff at Embassy Manyata in Bengaluru to EAAA Alternatives’ Real Assets Business

News4 days ago

News4 days agoDanube Group’s Rizwan Sajan to Host Bigg Boss 19 Contestants in Dubai on January 6–7

News2 weeks ago

News2 weeks ago2025 Set the Base: What India’s Real Estate Momentum Signals for 2026