News

Real Estate’s Financial Discipline Spurs Credit Upgrades, ₹400 Bn raised via IPOs Since 2021

Bengaluru, July 30, 2025: The real estate sector has continued to exhibit marked improvement in terms of financial health in the post-pandemic era, outperforming other major industries in the economy in terms of critical credit and financial metrics.

The last decade has been eventful for the real estate industry, resulting in structural changes. Events such as the Real Estate (Regulation and Development) Act, GST implementation, demonetisation, the Non-Banking Financial Companies (NBFC) crisis and the pandemic have only made the sector more resilient, transparent and competitive.

Particularly post-pandemic, the real estate sector has demonstrated a strong ‘V-shaped’ recovery. Overall, the financial prudence of real estate is reflected in the improving credit rating of companies driven by better operating and profitability margins, leverage ratios, etc.

Credit deployment in real estate on the rise

The sector’s access to credit has improved significantly in absolute terms though with evolving dynamics among banks and NBFCs. While the share of banks in overall credit exposure to real estate has increased notably and NBFCs have become relatively averse to real estate exposure post the 2018 crisis, the outstanding loan book for both banks and NBFCs has grown significantly in the last decade.

Gross bank credit in India has grown significantly from INR 109.5 lakh crore in FY 2021 to INR 182.4 lakh crore in FY 2025. Bank credit in the sector has impressively doubled in the same period from INR 17.8 lakh crore to INR 35.4 lakh crore. Importantly, real estate now accounts for close to one-fifth of the bank credit deployment in the country, signalling growing lender confidence in the sector.

Trends in gross bank loan book in India (in INR lakh crore)

Source: RBI, Colliers

Note: Data is for the financial year (FY). The real estate sector here includes commercial real estate and housing (including priority sector housing). Data is an aggregate of 41 scheduled commercial banks, which represent almost 95% of the total non-food credit deployed in India

Trends in NBFC loan book in India (in INR lakh crore) –

Source: RBI, Colliers

Note: Data is for the financial year. Data till September 2024. The real estate sector here includes commercial real estate and housing (including priority sector housing. NBFC data include the upper layer and mid-layer of institutions and exclude credit information companies, housing finance companies and standalone primary dealers.

In addition to increased lending to the sector, the quality of loans has also improved significantly. The proportion of gross NPAs (GNPA) in the construction industry loan book of banks has significantly reduced from 23.5 per cent in March 2021 to 3.1 per cent in March 2025.

“Indian real estate sector continues to demonstrate resilience and financial prudence even in the wake of external volatilities. In fact, the strong financial health of the sector is demonstrated by a significantly higher proportion of credit rating upgrades during FY 2025 as compared to upward revisions in other economic sectors,” said Badal Yagnik, CEO, Colliers India.

“The relatively higher credit quality of real estate loans is well supported by underlying strong demand-supply dynamics across multiple asset classes such as residential, commercial, industrial and warehousing, retail, hospitality, etc. Looking ahead, the overall outlook for Indian real estate remains positive in the near-mid-term amid sustained global as well as domestic investor confidence.”

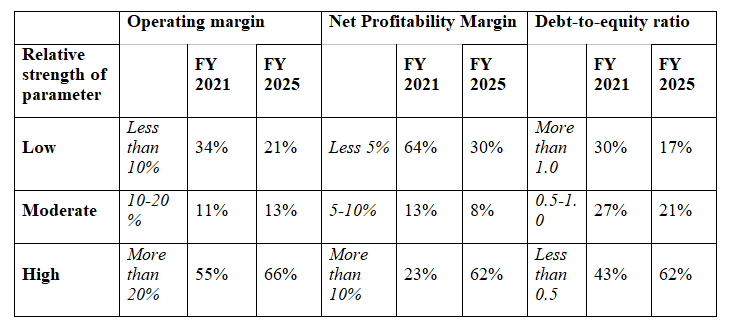

Profitability and leverage ratios improve for most larger real estate players

Increasing appetite for real estate lending by financial institutions has primarily stemmed from the financial prudence displayed by the sector. In fact, the top 50 listed real estate companies have shown an impressive improvement in terms of profitability, cash flow realisation and balance sheet performance over the last five years.

One of the most significant trends is the improvement in profitability metrics—62 per cent of the top 50 listed real estate companies had higher profitability margins at the end of FY 2025 compared to the 23 per cent share in FY 2021. Consistent strong demand, higher revenue realisation and better operating efficiencies can be attributed to the increasing profitability of real estate companies.

Additionally, the debt-to-equity ratio, a critical indicator of financial discipline, has shown consistent improvement over the past five years. More than 60 per cent of the leading real estate companies in India have comfortable debt levels, reflected in a debt-to-equity ratio of less than 0.5 in FY2025. This is particularly noteworthy considering that 43 per cent of the leading real estate companies were low-leverage companies in FY 2021.

Financial prudence at the special-purpose vehicle level has, in a way, culminated in comfortable debt levels at the consolidated level. Moreover, it highlights a deliberate strategy amongst large developers to deleverage and enhance capital as well as operational efficiency.

Comparison of key financial ratios for the top 50 listed real estate players in India (FY 2025 vs FY 2021)

Source: Industry, Colliers

Note: % indicates proportion of companies in each category for the top 50 listed companies

Creditworthiness of real estate sector reflected in a significantly higher number of rating upgrades

Most economic sectors have rebounded strongly post-pandemic. However, the pace and extent of recovery in the real estate sector have been comparatively more pronounced than in other industries. This is reiterated by a higher proportion of credit rating upgrades in real estate in recent years.

In fact, the real estate sector has outperformed the broader industry in credit quality metrics with a leading credit rating agency (CRA) reporting 23 per cent of upgrades in its rated real estate portfolio versus a mere 1 per cent of downgrades during the second half of FY 2025. The percentage of rating upgrades and downgrades across industries from the same CRA, meanwhile, stood at 14 per cent and 6 per cent, respectively, in the same period.

While the extremely high number of upgrades vis-à-vis downgrades in H2 of FY 2025 in real estate may rationalise over the next few years, it is still expected to outperform most economic sectors, driven by its inherent fundamentals. Rising revenues, improving operating and profitability margins and steady debt deleveraging underscore the adoption of more sustainable and disciplined financial practices in real estate, reinforcing its position as one of the promising sectors across the corporate landscape.

Credit ratio (rating upgrades/rating downgrades) trend in Indian real estate

Source: Leading Credit Rating Agency, Colliers

Real estate companies increasingly access equity markets to fuel expansion

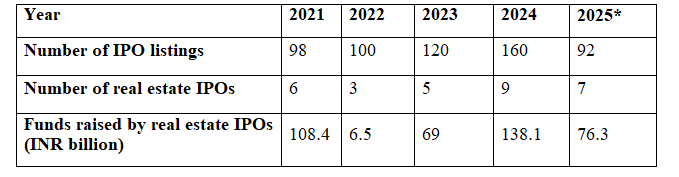

Real estate players are increasingly turning to public markets to raise capital as reflected in the surge of IPOs in recent years. In 2024 alone, India witnessed close to 160 fresh public issuances across sectors, comfortably outpacing issuances in 2023. Remarkably, the real estate sector saw nine IPOs in 2024, raising nearly INR 138 billion—almost double the amount raised in the previous year.

Since 2021, 30 IPOs have collectively raised close to INR 400 billion in the real estate sector. Heightened activity in the equity markets has continued into 2025 as well. The year has already seen 92 IPOs, including 7 real estate IPOs, till date.

Interestingly, real estate IPOs are expanding into newer categories such as flex spaces with leading operators scaling their portfolios across cities and fast-tracking their public listing plans. Moreover, the introduction of REIT and SM-REIT offerings is democratising real estate ownership for the retail investor. In the near to mid-term, several real estate companies, including Real Estate Investment Trusts (REITs), small and medium (SM)-REITs, hospitality players, residential developers and flex space operators are lining up for their IPOs with the regulator.

IPO trends: Heightened activity in recent years

Source: BSE, Colliers, Industry

Note: IPOs indicate listings on BSE, including both Mainboard IPOs and SME IPOs. Real estate IPOs include issues by developers, housing finance companies, flex space operators, REITs, public sector undertakings of the Ministry of Housing and Urban Affairs and companies from the hospitality segment. * Data as of July 2025

“Real estate players are increasingly tapping public markets to fuel their expansion and strengthen balance sheets, signalling growing investor confidence in the sector. The strong momentum seen in 2024 has carried into 2025 with seven real estate IPOs, raising more than INR 76 billion till July,” said Vimal Nadar, National Director and Head of research, Colliers India.

“Moreover, the diverse listings across segments, such as flex spaces, hospitality, office, residential, etc., and the anticipated upswing in SM REIT and REIT activity, are promising for the entire real estate sector. Indian real estate continues to draw strength from long-term stability and growing investor confidence, making it less vulnerable to global uncertainties.”

Looking ahead, the outlook remains particularly positive for residential and commercial real estate led by strong end-user demand, favourable demographics, rising disposable income and relatively lower interest rates.

However, real estate developers and investors must remain cautious of potential risks, including interest rate fluctuations, urban land acquisition bottlenecks and global economic headwinds that could moderate real estate growth.

News2 weeks ago

News2 weeks agoInfrastructure Automation Company Enlite Launches World’s First Patented Edge Controller for Intelligent Infrastructure

News1 day ago

News1 day agoTWH Hospitality Announces Aggressive F&B Expansion Plan with ₹30 Cr Investment

News2 weeks ago

News2 weeks agoIshara Art Foundation to Present Group Exhibition ‘Amphibian Aesthetics’ at Ishara House in Kochi

News2 weeks ago

News2 weeks agoGodrej Properties Crosses FY26 Annual Business Development Guidance with Acquisition of 75-acre land parcel in Nagpur

News3 weeks ago

News3 weeks agoMumbai Returns to Pre-Pandemic Investment Levels, Surpasses $1 Billion 4th Consecutive Year: Cushman & Wakefield

News2 weeks ago

News2 weeks agoReal Estate Investment Momentum in APAC, India to Hold Steady Through 2026: Colliers’ Survey Insights

News3 weeks ago

News3 weeks agoGurugram Premium Segment Drives Projected Rs 6.65 Lakh Crore Market: ANAROCK

News2 weeks ago

News2 weeks agoK2 Infragen Delivers Robust H1 with 76.5% Revenue Growth, 70% Profit Jump