Guest Column

Indian cities shed labels as office space trends diversify

Cities once known to be the long-time bases of specific occupier sectors are now experiencing a different and more divergent client patronage. This is because occupiers are increasingly trodding a different path by choosing cities that have not historically been associated with particular industries or business sectors.

Cities once known to be the long-time bases of specific occupier sectors are now experiencing a different and more divergent client patronage. This is because occupiers are increasingly trodding a different path by choosing cities that have not historically been associated with particular industries or business sectors.

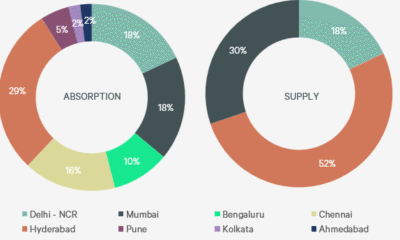

The last twenty-one months (January 2012-September 2013) have differed notably from what was generally observed in the seven years up to December 2011. 217 million sq ft of office space was leased between 2004 and 2011, and in the twenty-one months since then another 46 million sq ft was taken up by occupiers. Of this, the share of IT-ITeS companies in total space leased across India up to December 2011 was 43% – this has now fallen to 36%.

Mumbai, Pune, Kolkata, and the Delhi National Capital Region (NCR) strengthened their share of IT-ITeS leased space from 38% to 52%, whereas Bangalore’s share fell to 18% from 34%. Since January 2012, manufacturing companies have accounted for 28% of the total leased space across India – 7% more than their take-up up to December 2011. Bangalore turned out to be the dark horse, leasing 41% of its space to this sector and relegating the IT-ITeS sector to second spot with 35% of the city’s take-up. Prior to January 2012, the share was IT-ITeS 44% and manufacturing 26%.

Mumbai has attracted more IT-ITeS companies than anyone imagined likely, and Pune’s dependence on IT-ITeS has fallen from 59% to 45%. Since January 2012, the vacancy rate in IT Parks-SEZs in Mumbai has fallen to 24% from 29%, while that in non-IT buildings has risen from 16% to 21%. This trend may continue, as by December 2015 another 13 million sq ft of non-IT office space will hit the market – contrasting with just 6 million sq ft in IT Parks-SEZs. It is pertinent to note here that while IT Parks can host non-IT occupiers to a certain extent, IT occupiers have to operate from IT Parks-SEZs for business efficiency.

Mumbai has attracted more IT-ITeS companies than anyone imagined likely, and Pune’s dependence on IT-ITeS has fallen from 59% to 45%. Since January 2012, the vacancy rate in IT Parks-SEZs in Mumbai has fallen to 24% from 29%, while that in non-IT buildings has risen from 16% to 21%. This trend may continue, as by December 2015 another 13 million sq ft of non-IT office space will hit the market – contrasting with just 6 million sq ft in IT Parks-SEZs. It is pertinent to note here that while IT Parks can host non-IT occupiers to a certain extent, IT occupiers have to operate from IT Parks-SEZs for business efficiency.

Hyderabad has emerged as the city of first choice for healthcare, biotech, telecom, and construction companies, which together have taken up 28% of the total space leased in the city (up from 12% up to December 2011). This improved Hyderabad’s share to 16% (up from 8%) of total space leased across India for these sectors. Meanwhile, more consultancy companies have moved to NCR and the Banking, Finance and Insurance sectors (BFSI) has evidently re-assessed its hitherto singular focus on Mumbai and added Pune to its preferred destinations.

It will be interesting to observe how commercial space developers across cities respond to this new diversity trend. — (The author is Head, Research & Reis, JLL)

-

News1 week ago

News1 week agoMumbai’s Largest Trimandir Opens in Thane with Grand Three-Day Pran-Pratistha Ceremony

-

News1 week ago

News1 week agoBudget 2026: Real Estate Sector Awaits Real Reform, Targeted Relaxations For Boost

-

News4 weeks ago

News4 weeks agoPRANA by Nila Spaces Awarded Precertified WELL Residence Designation

-

News3 weeks ago

News3 weeks agoVianaar Homes Earns Great Place to Work® Certification in India

-

News3 weeks ago

News3 weeks agoBOOTES Enters Residential Development with ₹6,300-Cr Inventory, Redefining Luxury Through Clean-Air Living

-

News5 days ago

News5 days agoUnion Budget 2026: Infrastructure-Led Growth Sets Stage for Real Estate Expansion Beyond Metros

-

News4 weeks ago

News4 weeks agoDelhi-NCR Records 11.3 MSF Office Leasing in 2025; Leads With 19% Residential Price Growth: Knight Frank India

-

News4 weeks ago

News4 weeks agoMumbai Solidifies Position as Largest Residential Market in 2025; Office Leasing Second Highest in Decade: Knight Frank